To anyone in their 30s or 40s, retirement plans may seem like something that can be put off until a later date. Multiple financial pressures such as paying down a mortgage, covering the costs of growing children or funding further education costs often mean that long-term financial planning takes a back seat.

It is often the case that people begin to focus on their retirement plans when they accept that retirement is only a decade or so away; however not taking control of your pension plans earlier may have financial consequences, as regularly reviewing your pension arrangements is crucial to ensuring a secure and comfortable future. With constant changes in pension legislation, stock market volatility and potential changes in your financial circumstances, it is important that your retirement plans remain on track to meet your goals.

Identify savings gaps

Many people underestimate the value of pension assets needed to maintain their desired lifestyle in retirement. The full basic State Pension, whilst increasing to £230 per week from 6th April 2025, can only support a very basic lifestyle, and political parties have openly acknowledged that the so-called “triple lock” is under threat. This could mean that increases to the State Pension could potentially fall behind the cost of living over the next decade or two. It is therefore important to start thinking about the level of income that you would like to aspire to achieve in retirement and consider how your existing plans are placed to reach this goal. This could identify savings gaps that could be filled by increasing pension contributions, which may be easier to afford if made incrementally over a longer period.

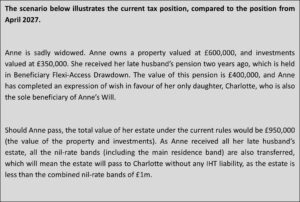

Working with an independent financial planner can help review your existing pension contributions and provide advice on the level of additional savings that may be required to meet your goals, and how to make contributions as tax-efficiently as possible.

Investment performance and the need to review

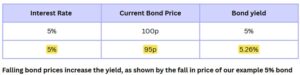

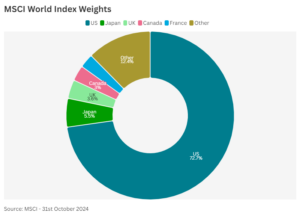

Defined Contribution pension funds are typically invested in a mix of assets such as equities, bonds, and property. Modern workplace pension contracts need to offer a “default” investment option, in which pension investments are held, unless a separate investment strategy is selected. The default investment option usually provides an element of auto-adjustment, known as lifestyling. Whilst this approach can vary from provider to provider, the premise is that in the early years, when you are some distance from your retirement age, the fund will invest largely in equities, with the aim of achieving long-term growth. As you nearer retirement, the mix of assets is automatically adjusted so that the allocation to lower risk assets is increased, with the adjustments eventually reaching a position where 25% of the portfolio is held as cash, with the balance held in a mix of assets, at the chosen retirement date.

For those who do not wish to take control of their pension, this approach is designed to avoid the potential for the value of pension savings to fall heavily just before retirement; however, taking control of your pension investments and making investment decisions, can produce outperformance and lead to a greater pension fund value at retirement. Furthermore, most lifestyle approaches are invested in passive investment funds only, which by their nature, will only ever track their benchmark index. Actively managed funds, invested in the same sector as a passive fund, could potentially outperform significantly, and considering your pension investments earlier in life can give more time for investment decisions to have an impact on your pension fund value, and the income it can generate in retirement.

Building a cohesive strategy

Most people accumulate multiple pension pots from different employers over their careers, and designing a cohesive overall strategy across multiple pensions with different providers can be complicated. Older pension contracts often carry higher ongoing costs than modern pension arrangements, which can impact on performance over time, and many only offer a limited range of fund options from which to create a good performing investment portfolio.

Consolidating older pension arrangements into modern style platform pensions can help bring order to deferred workplace pensions and provide the opportunity to put a cohesive investment strategy, designed to meet your attitude to risk and goals, in place. Undertaking such a consolidation exercise earlier in life provides greater time for the new investment strategy to outperform, and in doing so, can help the value of your pension fund reach a level required to provide a more comfortable retirement.

Working out a financial plan

Starting to consider a retirement plan can be a daunting task; however, working with an adviser can help identify your financial goals and priorities, and consider the level of contributions required to meet your retirement plans. Independent financial advice can also be vital when considering options in respect of existing pension arrangements you hold. Consolidating older style arrangements into a single plan is not right for everyone, as some pensions set up years ago can contain valuable benefits, such as guaranteed annuity rates or protected tax-free cash, which may be lost on transfer. A comprehensive independent review of your pensions can help identify such special features and critically analyse the charging structure and options within your existing arrangements.

Financial advice can also rearrange pension investments into a cohesive strategy, designed to meet your attitude to risk. Modern pension platforms provide access to a very wide range of investment funds from across the marketplace, thus avoiding the restrictions imposed by many workplace pensions. Speak to one of our experienced advisers to discuss your existing pension arrangements, and build a financial plan designed to meet your retirement goals.