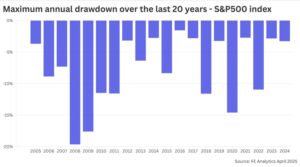

Anyone who has held investments through the last five years will have encountered uncomfortable periods when market volatility has increased. The outbreak of Covid-19 at the start of the decade, the Russian invasion of Ukraine, the ill-fated Mini-Budget of 2022 that led to the downfall of Liz Truss, and more recently the global tariff shock and increased instability in the Middle East, are all recent examples of global events that have led markets to retreat in the short-term.

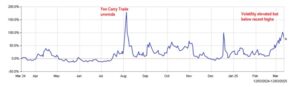

Given how markets have traditionally reacted to global events over recent years, some investors have been a little puzzled by the calm market conditions seen over recent weeks. The CBOE VIX index, which measures the volatility of the S&P500 index of US stocks, has barely suggested any sign of increased risk, despite the US involvement in the Israel-Iran conflict, which has the potential to lead to a regional war, and have wider implications for the global economic outlook.

Reasons behind the muted reaction

A major reason for the sanguine response to the escalation in the Middle East has been the suggestion that US involvement will be limited. We suspect market reaction would be different should the US be drawn into a wider conflict in the region. In previous periods of unrest in the Gulf, Oil prices have been driven rapidly higher, as fears grow over supply constraints, and indeed, this was also the case following the Russian invasion of Ukraine. Whilst the bombing of Iranian nuclear facilities did cause a minor spike in the price of Brent Crude, the reaction has been muted given that many feel that tensions could ultimately ease. Should oil prices remain around current levels, the potential for damage to the global economy is limited; however, actions, such as blocking the Straits of Hormuz, would undoubtedly see the price of oil soar.

Tariffs remain a threat

The instability in the Middle East is not the only current global factor that markets are seemingly taking in their stride. Away from global conflict, the tariff issue remains unresolved. Markets fell sharply immediately after the Liberation Day announcement on 2nd April and began to rebound once the US administration announced a 90-day pause a week later.

The trade deal struck with the UK recently is the first of what the US hope will be many that will be completed; however, time is running out before July 9th, when the current 90-day pause will end, and this poses the question, what happens next? Could the 90-day pause be extended, to allow additional time for deals to be struck? Will challenges questioning the legal basis of tariffs be successful? Or will Trump simply roll the dice again and reimpose the original tariff levels on trading partners? Markets will undoubtedly gain clarity in the coming weeks; however, given Trump’s unpredictability, the current market optimism runs the risk of discounting the potential for further turbulence when the 90 days expire.

Focus on fundamentals

Whilst markets grapple with geopolitical factors, other risks remain which could derail the current positive mood. We will shortly be entering the next quarterly reporting season for US equities, and markets will once again focus on the quality of US earnings, which may have been impacted by uncertainty over tariffs and weaker consumer confidence. Given the current market valuations, disappointing earnings reports could leave the valuations of some leading companies exposed.

The actions of the Federal Reserve could also pose a risk to the current positivity in global equities. Despite Trump’s regular demands that Fed chairman Jerome Powell starts to cut US base rates, the Federal Reserve have so far stayed resolute, highlighting the potential that tariffs could push inflation higher over coming months. Economists are also split as to whether any inflationary pressure would be short-lived, as companies readjust to tariff levels, or more persistent. Markets currently expect the Fed to cut rates twice this year, and any deviation from this path could lead to market disappointment.

Don’t discount market momentum

One theory that tries to explain the perceived complacency is that investment markets are simply growing increasingly numb to the seemingly endless stream of geopolitical noise and choosing to look for positive signs to support the current rally.

It is easy to build a case that suggests that current market valuations may become challenging as geopolitical factors weigh; however, market momentum remains strong, and further upside is possible in the short-term, if corporate earnings beat estimates and the Federal Reserve begin to ease the cost of borrowing. In short, markets could continue to ignore the risks and focus on positive factors that support valuations for some time to come.

As suggested in the famous quote attributed to John Maynard Keynes, “markets can remain irrational longer than you can remain solvent”. This may be an important mantra as we head through the coming weeks, if investment markets continue their upward momentum.

What action should investors take

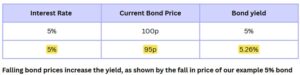

Diversification is a key component of sound investment strategy in all market conditions. Holding a diversified portfolio can ensure that you participate in periods when markets are on an upward trajectory, but also hold other asset classes, which may be more predictable, to protect the portfolio when volatility increases and markets retreat. For example, holding a position in fixed interest securities, such as corporate and government bonds, may act as a foil to global equities exposure, and help reduce overall portfolio risk.

Given the current conditions, and potential challenges that await, investors should look to review their current portfolio, to ensure that the asset allocation not only matches their needs and objectives, but changes in market conditions. Our experienced advisers can undertake a comprehensive analysis of your existing investments and provide an unbiased opinion on whether changes should be made. Speak to one of the team to discuss your existing portfolio.

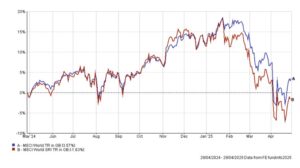

MSCI World vs MSCI World SRI indices, Total Return in GBP over 12 months. Source FE Analytics April 2025

MSCI World vs MSCI World SRI indices, Total Return in GBP over 12 months. Source FE Analytics April 2025