Amongst the more impactful announcements within the Autumn Budget were the proposed changes to the treatment of death benefits paid from a registered pension scheme. From 6th April 2027, most death benefits and unused pension funds held at date of death will form part of an individual’s estate for Inheritance Tax (IHT) purposes.

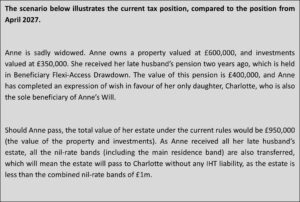

This is a significant change from the tax-advantaged position that currently applies. At present, unused pension funds, or remaining pension funds held in Flexi-Access Drawdown, can be passed to beneficiaries at the discretion of the pension trustees, outside of their estate for IHT purposes. This effectively allows unused pension funds to be cascaded through generations and is an effective estate planning tool.

Threat of double taxation

Not only could unused pension fund death benefits be subject to IHT, depending on the individual’s other assets, it appears that the existing tax rules for those drawing death benefits from a beneficiary’s drawdown pot will remain in place. If the pension holder dies before the age of 75, the beneficiary can draw down on the inherited pot without income tax applying to the payments, irrespective of whether the beneficiary draws ad hoc lump sums or a regular income. The situation is very different if an individual dies after the age of 75, where the beneficiary is taxed at their marginal rate of income tax on monies drawn from the pension. From April 2027, the value of the pension could potentially be subject to IHT at 40%, and funds drawn from the inherited pension could then also be subject to higher rate income tax (40%) or additional rate income tax (45%), once drawn, in the hands of the beneficiary. This could potentially lead to a total tax burden of 67% if the pension fund suffers IHT and the beneficiary drawing the pension is an additional rate (45%) taxpayer.

Spousal exemption remains

The position from April 2027 will remain unchanged when pension benefits are paid to a spouse or civil partner, as this will be covered by the IHT spousal exemption. Pensions left in favour of a surviving spouse will not be subject to IHT; however, just as is currently the case with assets other than pensions, the IHT liability will usually arise on the second of a married couple to pass.

Consultation process

It is important to note that the proposed changes do not come into force for another 2 years and 4 months. We therefore feel it would not be sensible to take knee-jerk decisions to adjust your financial plans.

The Government have launched a consultation with industry stakeholders, which will run until January 2025, to iron out how the new rules will work in practice. Any significant change to the proposals is unlikely; however, major logistical challenges remain on how the tax will be collected, and by whom. As the legislation seems to suggest that IHT on pensions will be due within six months of death, this will place considerable pressure on executors and pension scheme administrators to liaise and pay the right amount of tax due, to avoid interest being charged. Many legal experts are suggesting such changes may well introduce further delays to the probate process, meaning that beneficiaries have a longer wait before receiving funds from the estate.

The importance of holistic planning

Whilst no immediate action may be needed, it is important to begin to understand the implications of the new rules on unused pension funds and death benefits you hold. For those with unused pension funds, it will be important to review pension values to determine whether the change in rules alters the potential IHT liability on your estate.

There are a range of options that individuals who are holding unused pension funds could consider in order to mitigate a potential liability. These could include crystallising the pension and making gifts of the Tax-free Cash element, drawing additional income from a Flexi-Access Drawdown arrangement and making gifts out of surplus income or purchasing an annuity. You could also consider planning with other assets held outside of a pension, which could be invested to mitigate the potential IHT liability or look to protection policies.

It is clear that a holistic approach, which is tailored to the individual, will be key to effective planning, as the most appropriate option in each case will depend on the precise composition of assets held, family circumstances, financial objectives and attitude to risk.

The advisers at FAS always take a holistic approach to financial planning. We look at a wide range of aspects of an individual’s financial position, and as an independent firm, we can consider solutions from across the marketplace without restriction. If you have questions relating to the changes announced in the Budget, speak to one of our experienced advisers who will be happy to help.