One of the most important choices facing investors is where to place long-term investments. The choice of investment vehicle can influence the tax-efficiency of the strategy, the overall cost of the arrangement, and the potential for growth. For many investors, an Individual Savings Account (ISA) offers a tax advantaged route which is ideal for long-term investment, whereas Pension contributions receive tax relief, and Pension savings benefit from tax-free growth whilst invested. Beyond Pensions and ISAs, the tax implications of any investment plan need to be considered. There is, however, a further option that investors could consider, that can defer a tax liability or in some circumstances, remove it completely.

Investment Bonds in focus

Investment Bonds are products offered by life insurance companies, which combine features of both insurance and investment. For the uninitiated, Investment Bonds can appear complex structures, given the decisions that need to be taken when establishing the Bond, and the tax treatment of gains. This is where independent advice can prove invaluable in navigating the options available.

In simple terms, the first option when choosing an Investment Bond is whether to purchase a Bond from a UK based provider (so-called “Onshore” Bonds) or an International Bond provider, who may be based in Jersey or the Isle of Man. These are known as “Offshore” Bonds. As this choice will also dictate the tax treatment of the Bond, this decision requires careful consideration.

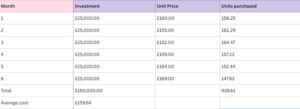

Unlike an ISA or Pension, Investment Bonds do not provide tax-free growth. They do, however, allow the investor to defer an income tax liability, whilst providing regular access to a proportion of the original investment. Investors can withdraw up to a maximum of 5% of the original investment each policy year, without triggering an immediate tax liability, although adviser charges are deemed to be withdrawals, and form part of the annual 5% allowance. As a result, the investor can potentially withdraw 100% of the original investment over a 20-year period, without any immediate tax considerations. The example below demonstrates the ability to draw regular sums from an initial investment of £200,000 into an Onshore Investment Bond.

| Initial Investment | £200,000 |

| 5% allowable limit per annum before incurring a tax charge | £10,000 per annum |

| Monthly Withdrawal payment | £833.33 per month |

Any withdrawals made above the accumulated 5% allowance, either as a larger lump sum or full policy surrender, is deemed to be a Chargeable Event and the gain is assessed for Income Tax on the investor. The precise level of tax payable will depend on whether the bond is held Onshore or Offshore, and the tax position of the investor. Further tax mitigation can be achieved through a mechanism where the gain is effectively “spread” over the number of years the Bond has been held.

Wider investment options

Historically, Investment Bond solutions were exclusively provided by the largest UK insurers, such as Aviva, Scottish Widows and Standard Life. This has presented challenges in terms of investment selection, as most contracts of this type offer a restrictive range of fund options from which to select. More recently, leading investment platforms have introduced modern Investment Bond contracts, which allow complete freedom of investment choice, including Discretionary Managed options. This wider range of options greatly enhances the attractiveness of an Investment Bond structure. In addition, such platform-based solutions are also competitively priced when compared to older insurance products.

Tax efficiency

The availability of more modern Investment Bond solutions is testament to their growing popularity as an investment option, much of which is due to changes in tax legislation.

The reduction of the Capital Gains Tax (CGT) annual exemption from £12,300 to £3,000 over recent years means that investors holding direct equities, or investment funds outside of an ISA or Pension, are more likely to face a CGT liability when disposing of investments. This is not a concern for investments held within an Investment Bond, as funds can be freely switched without creating a chargeable event.

The availability of the annual withdrawal allowance is another benefit, as this allows investors to establish a stream of regular payments, by way of an “income” without considering the tax implications.

Specialised uses

Investment Bonds can also be a sensible option when trustees consider how to invest trust funds, although this very much depends on the type of trust and objectives. As an Investment Bond doesn’t produce any income (unless a Chargeable Event occurs) or capital gains, this can ease the burden of administration on trustees.

Discretionary trusts are a particular example where an Investment Bond could be an option to consider. As such trusts pay Income Tax at a rate of 45%, the Bond structure defers this tax liability until a beneficiary requires funds from the trust. At this point, segments of the Bond can be “assigned” to the beneficiary, to encash at their personal rate of tax, which may well be lower than the rate that would apply if surrendered by the trustees. Whilst this could be a sensible way to structure an investment for this particular type of trust, it would not be appropriate for others, and we therefore recommend that trustees seek bespoke advice tailored to the precise terms of the trust.

The value of independent advice

The decisions behind the selection of an appropriate investment strategy can be complex and multi-layered. Aside from selecting the correct asset allocation and investment provider, the choice of product will influence the tax-efficiency of the arrangements, the costs and flexibility offered. Investment Bonds could be an ideal solution in certain circumstances; however, it is important that the right investment vehicle is chosen to meet the needs of each individual. As an independent firm, we can recommend products and solutions from across the marketplace without restriction. Speak to one of our experienced advisers to discuss the options in more detail.