Compared to the positive market returns enjoyed last year, 2022 has started in a turbulent fashion, with investment markets seeing selling pressure over the first three weeks of the year. Despite the increase in volatility, we feel this is, once again, a time for investors to stay the course.

Since the new year, the mood in investment markets has darkened, with risk assets seeing falls across the board. The catalyst for this weakness is a combination of a number of factors, rather than being the result of a single defined cause. Inflation is remaining stubbornly high and indeed increasing across developed economies. Higher energy costs, increased costs of shipping, scarcity of components, and labour shortages are all feeding into uncomfortable inflation readings. The actions taken by central banks to combat inflation will be watched more closely than ever, although we would hope that the Federal Reserve and Bank of England will continue to take a measured approach to higher prices, and continue to offer markets forward guidance of the path they expect to take.

On top of the concerns over inflation, the tense situation between Russia and Ukraine is also spooking investors. The threat of conflict is rarely taken as a positive by markets, as the risk and potential economic fallout is hard to quantify. In this case, a further concern is the potential disruption to European energy supplies.

Whilst Covid-19 measures are easing in the UK, it is important to note that this is not the case around the World. Omicron variant numbers remain high across the US and Europe and it would be unwise to write off the potential for Covid-19 to wreak more economic damage.

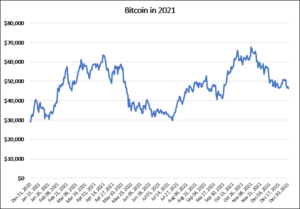

Taking these factors into consideration, it is perhaps not surprising to see markets take a step back in the short-term. It is, however, important to remember the speed at which economies and investment markets have recovered from the worst effects of the Covid-19 pandemic, almost two years ago. 2021 saw gains from most asset classes and sectors, with only a few exceptions, and irrespective of the factors dominating market attention at the present time, a pause for breath and consolidation was always likely to happen.

Despite the gloomy picture painted above, there are reasons that investors should remain positive. Corporate earnings have, by and large, held up very well, and given the waning impact of Covid-19, supply chain issues – which have been ongoing since the start of the pandemic – should begin to ease. Not only will this help industries from many sectors of the economy, but may also help ease some of the inflationary pressures later on in the year. Companies remain cash rich and further merger and acquisition activity remains likely. This is often seen as a further sign of confidence.

Unlike the very high levels of uncertainty seen at the start of the pandemic, we do not believe the price action seen during the first trading days of 2022 is a matter for great concern. Whilst our view could change as events unfold, the global economy is in a better place than it was two years ago, and in any prevailing market conditions, there are always investment opportunities to explore that could lead to outperformance.

Bouts of higher volatility, as we are seeing currently, are not comfortable, but are an essential part of the investment process. In conditions such as those being experienced currently, our recommendation to clients is to remain invested in a diversified portfolio of assets, which offers allocation to a range of asset classes and good geographic spread. It is also worth noting that returns on cash are deeply negative due to elevated inflation and unless central banks take dramatic action to increase base rates, which we feel is highly unlikely, cash returns may well remain deeply disappointing for the foreseeable future.

As always, the team at FAS remain vigilant to the prevailing conditions, and remain on hand to discuss market conditions with our clients. If you are interested in discussing the above with one of our experienced financial planners, please get in touch here.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.