With the tax year end approaching on 5th April 2026, now is the perfect time to review your finances and ensure you’re making the most of available tax breaks and allowances. The remaining time in this tax year offers a valuable window of opportunity as many of the tax breaks available to investors operate on a “use it or lose it” basis.

Maximise pension contributions

For most people, pension contributions represent the single most effective way to reduce their tax bill. When you contribute to a pension, you receive tax relief at your marginal rate. If you’re a basic rate taxpayer, every £80 you contribute becomes £100 in your pension. Higher rate taxpayers can claim an additional £20 back through their tax return, while additional rate taxpayers can claim £25.

Pension contributions can also be a highly effective way for those impacted by “cliff edge” allowances, such as those who earn between £100,000 and £125,140, to make even greater tax savings.

The Annual Allowance for pension contributions is up to £60,000 or 100% of earnings if lower, although those who have flexibly accessed pension savings in the past will be subject to a lower Annual Allowance. Individuals earning over £200,000 may also see their Annual Allowance tapered. As there could be tax penalties if you make contributions that exceed your Annual Allowance, we recommend you seek advice before making additional pension contributions.

Use your ISA Allowance

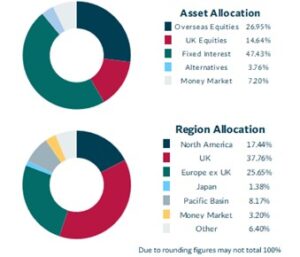

Individual Savings Accounts (ISAs) remain one of the most tax-efficient ways to save and invest, as you do not pay tax on interest or dividends generated from within the ISA, and assets sold within an ISA are not subject to Capital Gains Tax (CGT). They are also one of the key allowances that need to be used or lost, as allowances cannot be carried forward from one tax year to the next.

For the 2025/26 tax year, the ISA allowance stands at £20,000 per individual. This allowance can be split between a Cash ISA, Stocks and Shares ISA, Innovative Finance ISA, and Lifetime ISA (up to a certain limit). In addition, up to £9,000 can be invested in a Junior ISA, which can be held by a child up to the age of 18. These allowances will, however, change from April 2027, when those aged under 65 will only be able to use £12,000 of the maximum £20,000 allowance within a Cash ISA.

Strategic disposals to use CGT exemption

Those holding investments outside of an ISA or pension would do well to consider whether they should make use of the annual CGT exempt amount before 5th April. This is the maximum amount of gain that can be realised tax-free each tax year, and this exemption has become much less valuable over recent years, with the annual exemption standing at just £3,000 for individuals, or £1,500 for Trusts. Once the net total gain (once losses have been deducted) exceeds the exemption, CGT is payable on the net total gain at a rate of 18% (for basic rate taxpayers) and 24% (for higher and additional rate taxpayers).

It is also important to remember that married couples can transfer assets between themselves free of CGT, thus enabling both to use their available exemption.

Annual Gift Allowance

With Inheritance Tax planning taking on a higher priority in many financial plans, making use of annual gift exemptions could be a useful way of reducing the value of your potential estate for Inheritance Tax purposes. You can give away £3,000 per tax year (i.e. a couple can give away £6,000) and if you haven’t used the gift exemption in the previous tax year, you can carry forward any unused allowance; however, this can only be done for a single tax year.

Regular recurring gifts can also be made if you have surplus income over normal expenditure. The rules for such gifts are not straightforward; however, they can be a powerful tool for those with surplus income to make additional gifts without being subject to the seven-year clock that applies to capital gifts that exceed the exemption.

Gift Aid donations

An often-overlooked tax planning tool is the ability for higher and additional rate taxpayers to claim tax relief on charitable donations that are made via Gift Aid. In addition, as Gift Aid donations expand your basic rate tax band, making charitable donations could be particularly helpful to those whose income is just above the higher rate threshold (£50,270) or where their annual income sits between £100,000 and £125,140.

Time is of the essence

With time running out in the current tax year, it would be prudent to review your financial position to make sure that you are optimising your tax-efficiency. If action is needed, then we strongly recommend acting sooner rather than later – financial institutions are generally busy as we approach the tax year end, and processing lead times can increase. Furthermore, the Easter weekend falls just before the end of tax year deadline this year, leading to providers setting earlier cut off times for actions to complete within this tax year.

Engaging with a financial planner can help assess your financial position and potentially highlight gaps in your plans that could improve tax-efficiency. Our experienced advisers can carry out an unbiased assessment of your existing arrangements and provide advice on steps you can take to ensure your savings and investments are working hard and tax-efficiently for you. Speak to one of the team to start a conversation.