We come across many instances where trustees of an existing trust have carefully considered an appropriate investment strategy when the trust commences, giving due consideration to the terms of the trust, and the requirements of the Trustee Act. So far, so good; however, we equally come across trusts where funds have remained in the same investment strategy for many years, without any detailed scrutiny of the investment process or investment performance.

Investment management is an evolving process. Looking back over decades, the composition of a modern investment portfolio is very different to a portfolio that would have been seen as being appropriate years ago. In recent years, investment trends have increased the focus on passive investment funds, which offer a low-cost way of accessing a particular market index. Active fund managers now pay greater attention to environmental, social and corporate governance factors when constructing portfolios. These, and other factors, can influence portfolio performance, and with an increased focus on value for money, the costs of investment funds and fund management.

Reviewing investments

Keeping the provisions of the Trustee Act in mind, trustees should seek professional advice when carrying out a review of trust investments, unless they feel competent to carry out the review themselves. Our view is that reviews should be carried out at least once a year, and possibly more frequently, depending on the trust situation. The review should, of course, consider the portfolio performance, and adopting an appropriate benchmark can help trustees measure the performance of the portfolio against wider markets.

When investments are managed on an advisory basis, trustees should seek advice as to whether the current portfolio remains suitable given the prevailing and expected market conditions, and if any of the investments should be switched. If the portfolio is managed under discretion, it would be good practice to carefully analyse the decisions reached by the discretionary manager over the review period, and to ensure that the portfolio investments remain consistent with the original investment brief agreed at the outset.

The importance of diversification

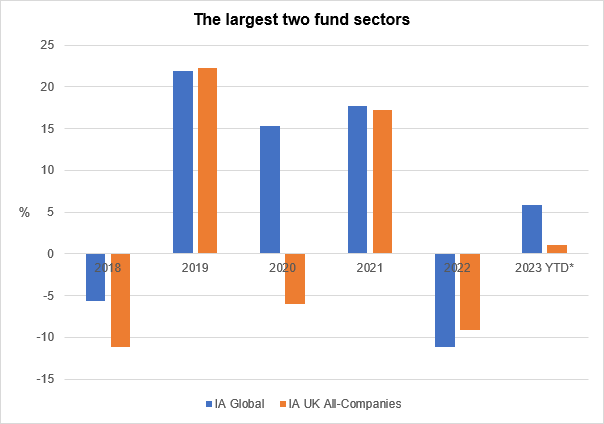

Over recent years, our experienced advisers at FAS have reviewed the trust investment strategies of a large number of trusts, which are managed by some of the biggest providers of discretionary managed services to professional and lay trustees. We have noted that many of these solutions tend to employ strategies that are focused on UK equities, and carry an underweight exposure to global equities, which may introduce additional risk, given the dominance of overseas Equities. To demonstrate, 70% of the MSCI World Index (which covers the largest 1511 global quoted companies) is weighted towards US equities, with just over 4% allocated to the UK. Whilst carrying such a small allocation to the UK is, in our opinion, a little extreme, it does underline the importance of global diversification in modern portfolio construction.

We have also noted that some discretionary managed strategies tend to offer unattractive income yields, which may not be appropriate where trustees are not only seeking capital growth, but need to produce a strong level of natural income which is paid to a life tenant. As the circumstances of a trust can differ widely depending on the position of beneficiaries, the time horizon and objectives, trust investment strategies need to be able to adapt to meet the precise requirements of the trust.

Review the trust and tax position

Other than considering the investment strategy, trustees need to regularly consider whether there is any change to a beneficiary’s requirements. For example, are minor beneficiaries close to reaching the age when they receive capital from the trust, and if so, should the trustees consider reducing investment risk. Or perhaps a life tenant’s circumstances have changed, which may mean a switch of portfolio strategy is needed.

Tax rules are also subject to frequent change, and trustees need to keep abreast of how any changes could affect their decisions. A good example of this is the reduction in the Capital Gains Tax allowance, which has more than halved in this Tax Year and will halve again from 6th April 2024. This will undoubtedly lead to more trusts being liable to Capital Gains Tax on a regular basis. Relevant Property Trusts are subject to a punitive tax regime, and by careful review of the various investment wrappers that are available, it may be possible to reduce the burden of tax on the trust. One such example is the use of an investment bond as a way of avoiding Capital Gains Tax considerations.

FAS Trustee Service

As you would expect, we regularly undertake detailed analysis of our portfolio performance and as part of this review, we consider the performance of some of the more common managed portfolio services offered by the largest providers of trust investment management services, and compare these to the performance of our CDI Discretionary Managed portfolios. We carefully monitor not only the raw performance data, but also other factors such as volatility and risk, which are important factors that trustees need to consider, together with fund charges and the management fee structure.

This regular review allows us to make comparisons of our performance against our peer group, and our analysis shows the performance of our CDI portfolios has been favourable when compared to some of the more popular discretionary managers who provide services to trustees. We have a well-defined investment process, which makes best use of our independent status. This allows us to select funds and solutions from the widest range of UK fund managers, allowing us to select the most appropriate investments without restriction.

If you are a trustee, it may be a good time to consider how your investment reviews are carried out. Speak to one of our experienced advisers, who would be pleased to carry out an independent and impartial review of the existing trust investments.