Within many pension schemes, default investment strategies now employ a process known as lifestyling, which claims to do the hard work of managing your pension assets for you as you get closer to retirement. However, adopting such lifestyle approach may well not be suitable for everyone.

What is a lifestyle pension strategy?

Lifestyle strategies are designed to effectively ‘lock in’ the investment growth built up in your retirement pot as you get closer to your designated retirement date. A lifestyle pension will start by investing a larger proportion of your retirement pot in equities, which offer the best potential for growth, with higher levels of risk. As you get older, and closer to your retirement date (typically 5-10 years before retirement), your pension will automatically start switching into lower-risk holdings, such as cash and bonds. The aim is that when you retire, and want to begin drawing your retirement benefits, you have a pot that is invested largely in a mix of cash and bonds and is less exposed to stock market volatility.

Pension providers like to talk about lifestyle strategies as offering a ‘glide path’, and there is a very good reason for doing it this way. After all, the last thing anyone just days from retirement would want to happen is to learn that stock markets have crashed, and a huge amount of their pension has suddenly been wiped out. A lifestyle pension takes away this risk because the pension has already been moving away from higher-risk assets into more low-risk investments over a number of years.

What are some of the advantages/disadvantages?

In theory, lifestyle pension strategies are a good idea, and certainly provide more certainty to individuals who do not wish to make investment decisions within their pension funds. That being said, lifestyle pension strategies still have a few drawbacks that anyone with a company pension would do well to be aware of.

Times have changed

Perhaps the biggest irony with lifestyle pensions is that they do not quite fit with the lives of today’s retirees. Retirement needs have changed considerably in the last few years. Some people are now choosing to retire later, either because they need to keep working or they don’t want to retire just yet. Others may want to reduce hours prior to retirement and begin taking pension income a little earlier.

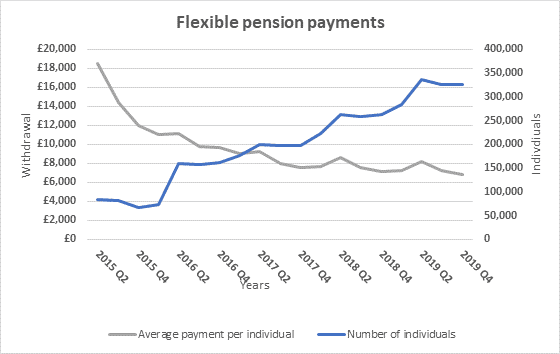

Also, lifestyle pensions were introduced back when it was compulsory for UK retirees to purchase an annuity in exchange for a guaranteed pension income for the rest of their life. But since compulsory annuities were scrapped back in 2015, it’s no longer a requirement to have a large pot of cash ready to buy an annuity when you hit retirement age. In recent years, using income drawdown has become a more effective way of receiving an income during retirement, as this avoids locking into the low annuity rates that we have currently.

Lifestyle strategies may not deliver the retirement flexibility you need

Another important factor associated with lifestyle pensions is their relative rigidity. When you start your lifestyle pension, you are expected to name your retirement date. Lifestyle pensions will focus on ‘growth assets’ in your early and middle years and, based on your ‘glide path’, will phase-in less volatile investments as your retirement date approaches. However, the timing of this shift from risky to less risky assets can make a huge difference to the overall size of the pension pot.

If your pension starts switching someone out of equities on your 45th birthday, because you told your company you planned to retire at 55, you could be missing out on a decade or more of investment growth, seriously limiting the final value of your retirement pot.

Switching from equities to bonds may not be the best investment strategy

Although owners of lifestyle pensions have done very well in investment terms over the last decade, this has been partly due to the strong performance of bond markets. This may not necessarily be the case over the next decade. The problem with a lifestyle pension is that it will make the switch based on the retirement date, rather than the conditions within investment markets at the time. At a time when everyone in retirement wants their money to go further, giving up ten years of investment growth may not be the right decision.

One size does not fit all

Lifestyle pensions became the default choice for company pensions because they offered a very straightforward method of pension planning – build up a pension pot and then purchase an annuity once you retire. But once you take annuities out of the equation, and make the retirement date a moving target, the simplicity of the lifestyle approach becomes less of a solution and much more of a problem. Based on the current economic climate and modern retirement patterns, there is an even stronger case to be made for keeping pension pots invested in growth assets well into retirement, choosing instead to take income via drawdown.

Have a conversation about your pension

If you have a company pension invested in a lifestyle pension strategy, it might be a good idea to discuss the details with us. We can ‘look under the bonnet’ of your current pension, and can help to determine whether it is set up to support your retirement plans. You only get to retire once, and an overly cautious investment strategy can be just as dangerous as an overly risky one. So, let us help make sure your lifestyle pension is really capable of delivering the lifestyle you want.

If you are interested in discussing pension arrangements with one of our experienced financial planners at FAS, please get in touch here.

This content is for information purposes only. It does not constitute investment advice or financial advice.