Positive early reaction

In the immediate aftermath of the election, US equities saw strong trading, with the S&P500 index pushing through the 6,000 level for the first time. A factor boosting the short-term positivity may well be the absence of uncertainty over the election result, which brought about market volatility in the aftermath of the 2020 election.

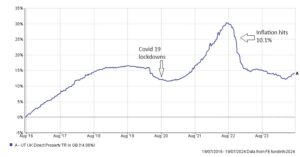

Whilst equities have reacted positively, bond yields have risen, as investors flee from US Treasuries. This reaction is understandable, as the likely policies a second Trump term will bring, such as tax cuts and increased tariffs, may well be inflationary. This could undo the work of the Federal Reserve, who have been successful in reducing inflation, so that it rests just above the Federal Reserve target. Markets have been anticipating a series of US interest rate cuts during 2025, which would help support a slowing economy. Depending on the speed and size of expansionary plans laid out by the Trump administration, the pace of interest rate cuts could slow, meaning interest rates remain higher for longer. This impacts the US housing market and could weaken consumer confidence.

A second Trump term may well herald a series of tax cuts, including those borne by business. This could improve US corporate profitability and potentially support higher valuations. An extension to personal tax cuts introduced in 2017, which are due to expire next year, is likely, which could ease some of the cost-of-living pressures currently facing US households.

America first policies

Trump consistently proposed the introduction of international trade tariffs during his election campaign, to refocus on domestic production, employment, and growth.

The extent to which tariffs are imposed remains open to question, as some of the more extreme claims made prior to the election could simply be used as bargaining chips; however, any extension of import tariffs has the potential to drive the price of goods and services higher, leading to higher inflation and a possible fall in consumer confidence. Countries are, of course, able to retaliate by imposing their own tariffs on US goods and services, leading to a trade war. This could dampen global growth, and lead to further friction, particularly with countries with significant export markets, such as China.

It is possible that mid-sized and smaller US companies could see higher demand for domestic goods and services due to higher tariffs, although weakness in consumer confidence and higher prices could offset any benefit to US domestic suppliers.

Trump and global conflict

On balance, the second Trump term increases the potential for market volatility due to geopolitical instability. The World waits to see actions Trump could take in respect of the Russian invasion of Ukraine. Such decisions could have wider implications for the future of NATO and could see European nations increase spending on defence. Should the conflict end, this could well secure energy supplies going forward and remove the risk to potential supply shocks that caused market concern at the outset of the conflict.

Commodity prices may also be influenced by events in the Middle East. The ongoing tensions in the region have yet to cause significant concern to global equities and commodity markets over the course of this year; however, actions taken by the new administration could increase tension and any significant escalation could see oil production fall, potentially leading to higher prices.

Sector winners and losers

A range of sectors of the US economy are likely to be direct beneficiaries of policies introduced by the Trump administration, whilst others could face a more difficult future. Banks and Financials may well benefit from lower government regulation and red tape, and if US interest rates stay a little higher for longer, this could boost profitability. Oil and Gas producers may also be big winners, given the suggestions that Trump will look to expand US production. On the other hand, the renewable energy sector has already come under pressure since the election result, as Trump may well reduce tax credits and other incentives that have driven the boom in renewables across the US.

The largest US tech stocks have contributed a considerable proportion of the growth seen in US markets over the last year, and these tech giants have seen significant inflows at the expense of more traditional sectors of the economy. The difference in performance between high growth and value stocks has been clear, and this gap may well narrow following the US election result. The outcome may also benefit mid and smaller sized US companies, which have underperformed the mega-cap global giants.

Implications for portfolio asset allocation

In the wake of the US election result, equity markets have rallied on the expectation of corporate tax cuts and deregulation, coupled with relief that the election result was clear cut, without the uncertainty seen following the result in 2020. Treasury markets have given a less positive reaction to the Trump re-election. Given that policy decisions are likely to increase borrowing and fuel inflation, bonds have come under pressure, as inflationary fears have the potential to derail the Federal Reserve’s intended path for US interest rates.

2024 has proved fruitful for investors, and the outlook for 2025 appears robust; however, decisions taken by the second Trump administration in respect of both domestic and foreign policy may well increase volatility, as well as opening opportunities. As we head into more uncertainty, it would be an appropriate time to review existing investment portfolios to consider the asset allocation and strategy adopted. Speak to one of our experienced advisers to discuss your exposure to US equities and how the election result could impact market sentiment.