Many investors will look back at 2024 and be satisfied with returns from investment markets. Whilst pockets of positivity remain, 2025 may well be a year when investors are likely to face more testing conditions than the calm waters seen last year. We look at five themes that could shape market direction over the next twelve months.

Broadening of US market performance

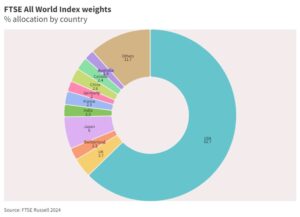

2024 was a year when technology stocks dominated investor attention. And rightly so, given the consistently strong earnings updates throughout the year, amidst increased focus on the potential for Artificial Intelligence (AI) to boost earnings growth over the medium and longer term. Given the demanding valuations of leading tech names, investors may increasingly look to other sectors of the US economy, where valuations are less expensive. Given the sheer size of the largest tech stocks, any extended period of weakness will have a direct impact on index values, and 2025 may well be a year when taking a selective approach to asset allocation will yield outperformance.

Another variable is the impact of an incoming President Trump. Expected cuts to corporate tax rates may well help support investor sentiment, and relaxed regulation could help provide a boost to banks and financials. The Oil and Gas sector could also see renewed interest, given the anticipated policy decisions.

Tariffs – words or action?

One of the biggest unknowns as we enter 2025, is the extent to which Trump will follow through on threats to impose tariffs on the US’ trading partners. Trump has stated that tariffs will apply to imported goods from China, Canada and Mexico from day one of his second term in office. Trump imposed tariffs during his first term in office, in an attempt to boost jobs and industry, and clearly favours extending import duties; however, the extent to which Trump’s threats are followed through is open to question.

Increased costs could stoke US inflation and could damage the growth potential for major export nations who trade with the US. Trading partners are unlikely to take the imposition of tariffs lying down and could retaliate, leading to a global trade war.

UK economy to enter recession?

Whilst it is too early to speculate on whether the UK will enter a technical recession in 2025, the warning signals are flashing red. UK GDP growth was negative for both September and October, with August being the only month showing positive month-on-month growth over the second half of 2024.

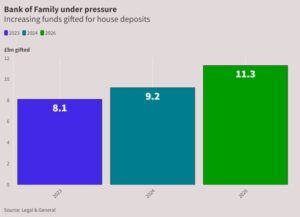

Recruitment firms have seen a drop in job vacancies, with companies from a range of sectors suggesting that the increase in Employer National Insurance and minimum wage from April will add further pressure. Household finances remain under similar pressure and consumer spending remains weak, with early reports of sluggish retail sales over the key pre-Christmas period.

Japan to push forward

2024 was a key year for the Japanese economy, which finally appears to have shrugged off the spectre of deflation. Equity markets responded well to the normalised conditions, with the Nikkei 225 breaching levels not seen since the 1980s. Despite the strong performance over the last year, Japan continues to be an interesting investment opportunity. Compared to other global markets, such as the US, valuations are undemanding, and further normalisation of monetary policy, and increased wages, may boost domestic consumer spending.

Despite the positive outlook, investors need to be mindful that Japanese equities may be volatile. August 2024 saw a sharp fall and rebound in the Nikkei 225, largely due to the Japanese Yen being used as a funding currency for investment overseas, and decisions taken by the Bank of Japan could see the “carry trade” unwind.

Interest rates to nudge lower

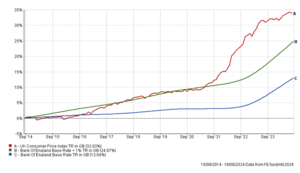

2025 should see global central banks continue to cut base interest rates, in response to moderating inflation data. The Federal Reserve, Bank of England and European Central Bank announced a series of rate cuts during the second half of 2024, and whilst further cuts are likely during 2025, central banks will be keeping a close eye on key economic data before committing to further cuts. Inflation figures will, perhaps, be the most important factor that central banks consider, and the Bank of England will be closely watching the jump in inflation seen in October and November, which saw the Consumer Prices Index (CPI) move away from the 2% target.

The US Federal Reserve have a similar conundrum. Inflation dropped consistently in 2024 to reach 2.4% in September, before rebounding in October and November. Whilst the Fed cut US interest rates at their December meeting, Chairman Jerome Powell warned that the Fed would tread cautiously before implementing further monetary easing.

Bond markets may well remain nervous, despite the direction of interest rates. Government Bond yields in the UK and US rose during the fourth quarter, largely due to concerns over the state of government finances. UK Gilt yields have climbed to levels not seen since 2023, on the back of the October Budget, and US Treasury Bond yields have also risen following the US election result.

Time to review portfolio strategy?

2025 may not be the comfortable ride that last year proved to be for many investors. There are, however, always opportunities for outperformance. Given the expected conditions, investors would be wise to review investment strategies to ensure that their portfolio is invested appropriately. Seeking independent advice can help analyse your existing investment approach and provide recommendations to adjust strategies. Our team of experienced Advisers are on hand to provide impartial advice. Speak to one of the team to discuss how your portfolio is positioned as we enter 2025.