The key anxiety affecting market confidence is the impact a prolonged regional war could have on global energy supplies. Around 20% of global oil supply passes through the Straits of Hormuz, where tanker traffic has effectively ceased due to drone attacks, and understandably, insurers are not willing to cover traffic movements. The US has mooted the possibility of providing insurance and naval escort, which may help ease the logjam.

Despite this, oil prices are likely to remain elevated for the foreseeable future, and gas prices have also jumped higher after Qatar temporarily halted the production of liquified natural gas; however, to put the price increases in context, Brent and WTI crude prices still remain a considerable way below the highs seen just after the Russian invasion of Ukraine in 2022.

The partial blockage of the Straits of Hormuz is likely to weigh most heavily on countries that rely on energy supplies from the Gulf, such as Japan, South Korea, and India. In addition, freight that now needs to use the route around the Cape of Good Hope will be subject to delays in reaching its intended destination and additional costs.

Furthermore, broader conflict of this scale is likely to weigh on specific industries such as tourism and could potentially have a broader impact on consumer confidence, particularly if an expected hike in energy bills adds further pressure to household budgets.

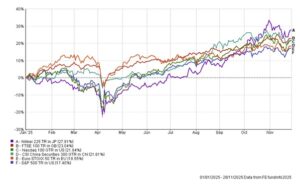

Thus far, global equity markets have only given back a small percentage of the gains made over the last 12 months; however, the conflict adds to an already complex picture, with markets contending with the fallout from the US Supreme Court decision on tariffs and increasing investor concern over the funding of major capital expenditure by the world’s biggest technology companies.

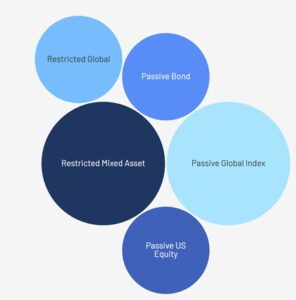

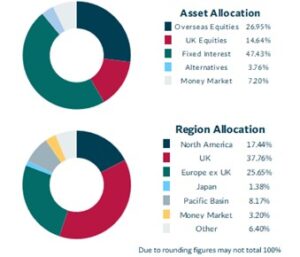

Given concerns over valuations and perceived market complacency, the FAS Investment Committee took the decision to reduce allocations to US equities in the CDI portfolios in both August and October of last year, and the CDI portfolios continue to carry higher levels of cash than would usually be the case. This allocation insulates against further market uncertainty in the short term. The CDI discretionary managed portfolios are also well diversified, holding exposure to equities across a range of sectors and regions, and carry a good proportion of actively managed funds, where fund managers will be reviewing asset allocation to position their portfolios to take best advantage of the prevailing and expected conditions.

A sustained regional conflict is also likely to exert an increasing impact on monetary policy. Should energy prices remain elevated, this will impair central banks’ ability to cut interest rates to bolster flagging economic growth. The Bank of England may well adopt a “wait and see” approach, before taking action to cut interest rates further. In the US, markets are now expecting no further easing by the Federal Reserve until June or July. As a result of the changing outlook, bond yields have risen over recent trading sessions.

Despite the expected path for interest rates, the FAS Investment Committee have continued to focus on short-dated corporate debt over recent months, due to concerns that inflationary pressures could resurface. This outcome now appears more likely; however, our focus on bonds with less than five years to redemption should provide insulation if bond yields continue to rise in the short to medium term.

The outbreak of conflict in the Gulf is a sharp reminder of the need to hold a diversified investment portfolio, to limit exposure to sectors and regions that are likely to face the greatest impact. History has consistently shown that those who maintain a disciplined, long-term approach are rewarded for doing so, despite periods of volatility. Market sentiment can change rapidly, and attempting to trade conditions such as those we are currently experiencing is not a sensible course of action.

We do not believe the events of recent days merit a material change to the longer-term outlook for global markets, although should the conflict endure for an extended period, this may have an increasingly negative impact on market sentiment in the short-term. The FAS Investment Committee have carefully reviewed the CDI portfolios in the wake of recent events and feel that the portfolios remain well positioned both in terms of asset allocation and portfolio strategy.

Whilst the next review and rebalance for the CDI portfolios is scheduled for May, the FAS Investment Committee will remain vigilant to events, and if they deem action is appropriate, can arrange an ad hoc rebalance at short notice.

We hope these comments help to provide reassurance; however, please do contact us if you have any questions or concerns.