For many people in retirement, pensions will form the foundation of their income. For those with sufficient qualifying years, the full State Pension now provides an income equivalent to just under £12,000 per annum, and most retirees can access pension income from workplace and personal pensions accrued during their lifetime, which covers the essential costs of living. Pension income alone may, however, leave little spare for discretionary expenditure or unexpected outgoings.

A well-rounded retirement income strategy does not necessarily need to rely on pension income alone to fund retirement. Savings and investments can be used to generate additional income, which is often more tax-efficient and flexible than income from pension sources.

Diversification is important

Some may be tempted to focus on holding their savings exclusively in cash deposits. Whilst cash forms a part of all sensible financial plans, and carries minimal risk, it is important to bear in mind that the level of interest is likely to be modest, and with interest rates set to fall further this year, those relying on savings interest may well see their income fall. Furthermore, cash is fully exposed to the eroding impact of inflation over time.

Property remains a popular source of retirement income for many individuals. Income from rents can provide a stable income stream and may increase with inflation over the long term. Rental income is not, however, tax efficient, as rental profits are subject to income tax and landlords are increasingly finding the burden of regulation more difficult to manage.

Equities (company shares) can provide an attractive and potentially increasing level of dividend income. Stable companies aim to return excess profits to shareholders in the form of dividends, with many global companies producing an increasing level of dividend year on year. It is, however, important to remember that dividend income is not guaranteed, and the capital value of holdings in equities will fluctuate, depending on underlying market conditions.

Corporate and Government Bonds are another way of generating income in retirement. Most fixed interest securities offer a predictable and attractive income stream, and whilst fixed income investments tend to be less volatile than equities, capital values will fluctuate depending on economic factors and bond interest may be at risk, if the financial strength of the bond issuer weakens.

By blending allocations to these asset classes, a diversified investment portfolio can be created, providing an attractive level of income that can supplement pension income, and provide some prospects for capital appreciation, too.

Improved tax-efficiency

Pension income, be it from a workplace pension, Flexi-Access Drawdown or an annuity, is subject to income tax. In contrast, an investment portfolio can be structured to make best use of available tax allowances to create a tax-efficient natural income stream.

Individual Savings Accounts (ISAs) are often the cornerstone of income planning outside of pensions. ISA income is tax-free, and ISAs also provide an additional benefit in that any gains generated on the sale of investments within an ISA are also free from Capital Gains Tax.

Once ISA allowances have been fully used, General Investment Accounts can provide additional investment capacity. While income from these accounts is taxable, most individuals receive a Personal Savings Allowance, which covers up to the first £1,000 of savings income each tax year, and a Dividend Allowance, where the first £500 of dividend income each year is also free from tax. By carefully structuring their assets, a couple could fully use their ISA allowances each tax year and make use of the other available tax allowances to cover savings and dividend income.

Added value through advice

Creating income outside of pensions is not about replacing pension income but strengthening it. By building and managing non-pension assets, those in retirement can reduce reliance on any single source of income and improve long-term financial security. As with all retirement planning, it is vital to ensure that the strategy is tailored to your needs, meets your attitude to risk and is adequately diversified. Our experienced advisers can add significant value by providing independent holistic financial planning advice, and our ongoing review service can help ensure these strategies remain aligned with changing circumstances and objectives.

Introducing CDI High Income

When seeking a high level of natural income, one option is to build a bespoke portfolio, designed to provide an attractive and reliable income stream. Our advisers regularly construct such portfolios for specific client requirements; however, growing demand for a strategy designed to generate a higher level of income has been the catalyst for the CDI High Income portfolio, the newest discretionary portfolio strategy managed by the FAS Investment Committee.

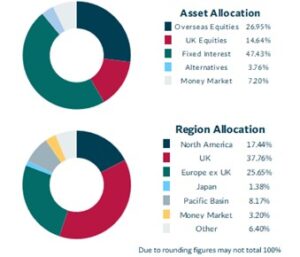

The CDI High Income portfolio has been designed to generate a higher level of natural investment income while still offering the potential for long-term growth. Being defined as medium risk, around 40% of the CDI High Income portfolio will be invested in UK and global companies that can deliver attractive dividends. The remainder is held in a mix of fixed interest securities combining both high-quality and higher-yielding issuers to balance income and risk. As with all CDI portfolios, the FAS Investment Committee review and rebalance the portfolio at least four times a year, considering fund performance, global macro factors, and market outlook.

As of 31st December 2025, the yield on the CDI High Income portfolio stood at an attractive 5.03% per annum, which could make the strategy an ideal option for anyone seeking to generate additional income from savings, as part of a wider strategy. The high natural income also lends itself well to those who wish to generate income for the purpose of making gifts out of surplus income, or for trusts, where a life tenant is seeking a higher level of income.

Speak to one of the team to discuss the CDI High Income discretionary managed portfolio.