Inheritance Tax (IHT) planning was once only considered necessary for the very wealthy; however, largely because of increases in property and asset prices, many more estates are now liable to IHT. The most recent data from HMRC showed that IHT receipts were £3.5bn for the three months to August 2024, an increase of 10% over the same period last year. Whilst this upward trend is likely to continue, careful financial planning can help reduce or eliminate an IHT liability and leave a greater proportion of an estate to beneficiaries.

IHT legislation

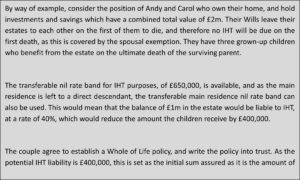

Existing tax legislation provides each individual with a ‘nil rate band’ of £325,000 which is exempt from IHT. Married couples can use two nil rate bands on second death meaning that estates valued at less than £650,000 will pay no tax. This can be further extended by the ‘main residence nil rate band’ which can be claimed in respect of the main family home, of £175,000 per individual, as long as the home is left to a direct descendant. The main residence band can also be transferred between married couples, and as a result, a total of £350,000 can be covered by the main residence band on second death.

Any amount exceeding the total ‘nil rate band’ is taxed at 40%, which can have a major impact on the legacy you leave to your beneficiaries. There are, however, a range of financial tools available to help mitigate a potential IHT liability.

IHT mitigation via life assurance

Amongst the IHT mitigation strategies available for consideration, life assurance could be a sensible option that is worth considering. A specific type of life assurance policy, known as a Whole of Life policy, is used for this purpose. Unlike traditional term assurance policies that provide cover for a set period, Whole of Life protection is designed to cover the life insured for the rest of their life, as long as the insurance premiums continue to be paid.

Whole of Life cover can either be taken out on a single life assured, or jointly. For married couples, where their estates are left to each other on the first to die, the IHT liability will generally arise on the second death, and therefore joint policies are often established on a “joint life, second death” basis.

The key planning element when using a Whole of Life policy is to ensure that the policy is written into trust, so that the payment on death does not aggregate with the individual’s other assets when their estate is assessed for IHT purposes. On death, the trustees use the policy proceeds to pay towards the IHT liability on the estate, which could potentially be covered in full.

Depending on the policy options chosen, the life assurance premiums can be guaranteed, in other words they remain unchanged for the life of the policy, or reviewable. Choosing the latter option will lead to cheaper premiums in the early years of the policy, but premiums will increase over time. The level of premium payable will be determined by an underwriting process, where the premium takes into account the age, health and lifestyle of the applicant. In most cases the policy will not pay out in the event of death within the first 12 months of the policy.

It is important to ensure that premiums remain affordable throughout the life of the policy. As a result, we often provide advice to help clients generate an income stream from existing investments, which can be used to pay the monthly or annual premiums.

Selecting cover options

When we sit down with clients to look at IHT planning options, we stress the importance that determining the value of an estate is just a “snapshot” of the current position of their existing assets. Of course, the value of an estate can shift significantly over time, either due to increases in the value of investments or property or further inheritance received. It could also be reduced, due to the eroding costs of long-term care, or other planning measures undertaken, such as direct gifting to family members.

It is also important to appreciate that IHT legislation can alter over time, and although the nil rate band hasn’t increased since 2009, the introduction of the main residence band in 2016 is a good example of how changes in legislation can impact on existing planning measures put in place.

Some Whole of Life policies allow the sum assured to be increased over and above increases in prices generally, which is an option that is available in most cases. That being said, given the relative inflexibility of Whole of Life policies, it may be appropriate to consider using protection policies as part of a broader strategy to mitigate a potential IHT liability.

The power of independent advice

Although IHT receipts are increasing, by planning ahead, the impact of this tax can be avoided or even eliminated. Our experienced holistic planners can fully assess the potential IHT liability on your estate and consider the options, including protection policies written in trust, as part of a broader financial planning strategy. Speak to one of the adviser team to discuss what action may be appropriate to meet your circumstances.