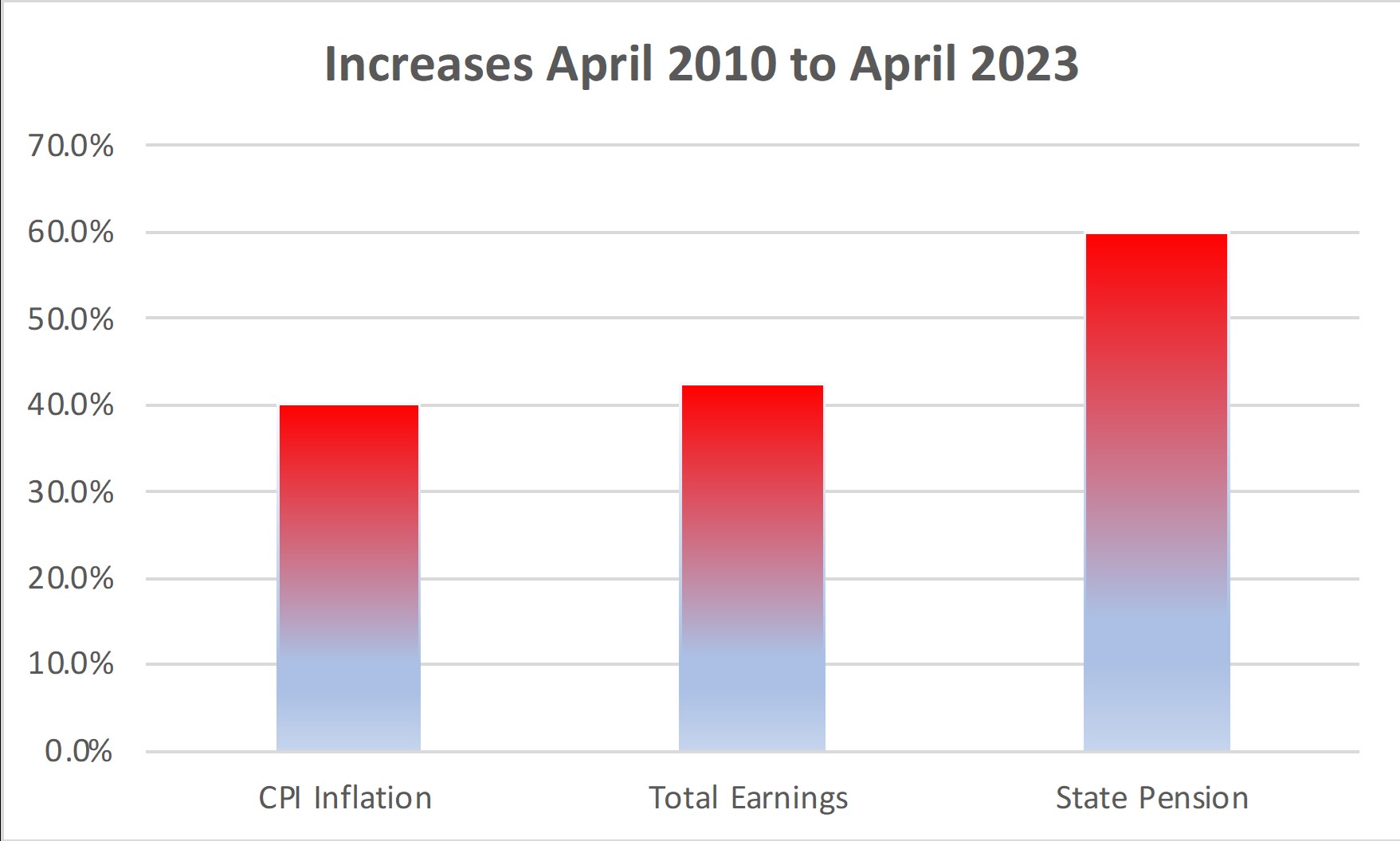

State pension increases could be outpacing inflation next April, and there’s no guarantee of the Triple Lock surviving the next election.

In mid-September, the Office for National Statistics (ONS) published the latest earnings data, covering the period May to July 2023. Earnings data has been the focus of much attention recently because a fall in the pace of pay growth is seen as a pre-condition for the Bank of England to consider a pause – and eventually cuts – in interest rates. However, the data that emerged in September was doubly important as, in theory, it sets the level of increase for the old and new state pension from April 2024.

Both the old and new state pensions are subject to the Triple Lock, which means they are due to increase by the greater of:

- Annual earnings growth (including bonuses) for the May to July period;

- Annual CPI inflation to September; or

- 5%.

Given the publicity it receives, you may be surprised to learn that the Triple Lock is nowhere to be found in pensions legislation. The Triple Lock is a discretionary feature that the government can ignore, although with an election almost certain in 2024, it would be difficult to imagine that it would depart much from its requirement this year.

May to July earnings total earnings growth this year was 8.5%, 0.3% higher than expected, a surprise that the ONS attributed to NHS and civil service one-off payments in June and July. That means from next April the old state pension will rise by £13.30 to £169.50 a week and the new state pension (applying to those who reach state pension age after 5 April 2016) will increase by £17.35 to £221.20 a week, unless the government decides to suspend the Triple Lock. It did so in 2022/23, when Covid-19 distorted earnings data and for 2024/25 it could tweak the earnings definition to exclude those one-off payments.

Whether the Triple Lock will survive beyond the next election is unclear. Shortly before the earnings data was published, the Prime Minister refused to commit to the Triple Lock being in the Conservative manifesto. At about the same time, the Institute for Fiscal Studies published a critical report saying that the Triple Lock created uncertainty both for the government and for individuals planning their retirement.

If you find yourself thinking you could retire on £221 a week, think again. It represents less than two thirds of this year’s 35-hour week National Minimum Wage.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Source: IFS.