We firmly believe the value of financial advice has never been greater. Whether trying to navigate global markets in an ever-changing World, or tackling an increasingly complex tax regime, good quality financial advice can deliver clarity and help you build a cohesive financial planning strategy, so you can face the future with confidence.

Selecting the right financial adviser can, however, be daunting, and one of the first decisions that needs to be reached is whether to use an independent or restricted adviser. Independent financial advisers are not tied to any specific financial products, providers or investment institution, so they can offer impartial advice tailored to their client’s needs. In contrast, restricted advisers can only recommend certain products and solutions from a very limited range of options, and in some cases, will only be able to recommend products from a single provider.

Both independent and restricted advisers must have achieved the requisite level of qualification and be properly authorised. Taking advice from a restricted adviser may, however, lead to missed opportunities due to the lack of freedom to choose investment solutions and funds from across the marketplace.

A changing landscape

The frequent changes in legislation seen over recent years are leading many people to consider a change of course within their financial plans. With unused pensions falling within the scope of Inheritance Tax from April 2027, Trusts and other planning tools such as investments that aim to qualify for business relief, are being used more readily to help families pass down wealth tax-efficiently between generations. More individuals are paying greater levels of Income Tax, reinforcing the importance of tax-efficiency using tax wrappers, and investments that provide tax relief, such as Venture Capital Trusts (VCTs).

To meet the changes in legislation, product providers are creating new solutions. Using an independent adviser will mean that an adviser is free from constraints and can select from these products if they fit a client’s needs and objectives; however, a restricted adviser may be unable to recommend the product if it is not within the panel of options permitted through the restricted advice process.

Another key advantage an independent service has over a restricted adviser is the freedom to select platforms, funds and product providers from across the marketplace, which can also ensure that solutions are cost-effective. As providers launch new services, and existing products are revamped, an independent adviser can actively compare options to aid cost effectiveness.

Investment options

One of the key differences between restricted and independent advisers is the breadth of choice when constructing investment portfolios. Restricted advisers generally build their investment proposition from a prescribed range of funds, which are generally managed by a centralised investment function. Whilst many of the major restricted advice firms use external managers for their investment solutions, the adviser will only be able to choose investments from the pre-selected available panel of funds.

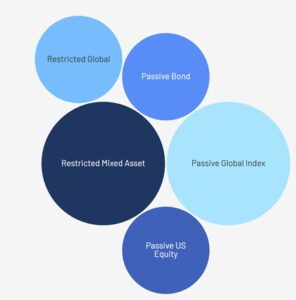

This proves to be an efficient solution for the restricted adviser firm but may not be for the client. Due to the limited range of options offered by restricted advisers, the fund sizes in the most popular restricted mandates have increased to significant proportions. The visualisation collates the largest collective investment funds available to UK investors, which each have more than £20bn under management, and demonstrates the size of the most popular restricted funds, the largest of which now stands at over £43bn.

A major drawback of such large mandates is that the portfolio will largely be passive in nature, with little room for outperformance that can be generated by active management. Furthermore, smaller fund houses, with expert managers and a strong track record of performance, would simply be out of reach of the largest restricted advice propositions.

By way of contrast, an independent adviser can select investment funds from across the range of available funds without restriction. This means the investment solution will be constructed from research and analysis which considers a much broader range of potential options, leading to a more nimble proposition that can readily adapt to changes in market conditions.

Making the most of our independent status

The financial services industry continues to evolve, resulting in the creation of new solutions, and existing products are updated regularly. As an independent firm, we are free to access and recommend such solutions to our clients.

Our Investment Committee undertakes regular reviews of available platform services, and we use independent and external research that enables us to select the right option that is tailored to our client. The Committee also uses expert external analysis to review esoteric products such as VCTs and Enterprise Investment Schemes, which may not be offered by a restricted firm.

Investment returns are directly influenced by portfolio construction and investment selection can make a significant difference to the cumulative returns achieved over the longer term. Our Investment Committee carries out research on all funds available to UK investors on a quarterly basis, leading to an approach that seeks to find the “best of breed” without restriction.

We are proud of the independent holistic advice service that we provide to our clients, and our advice process takes full advantage of our independent status, aiming to tailor the most appropriate financial solution to every client circumstance. Many adviser firms have taken the decision to adopt a restricted approach, which may well have been the right choice for the firm in question, but not necessarily for the client.

Speak to one of our experienced and independent advisers to discuss your financial plans and review your existing arrangements.