Over four in every ten criminal offences carried out in the UK each year involve financial fraud. Despite the financial services industry taking steps to crack down on financial fraud over recent years, our growing reliance on technology is opening new doors to would-be scammers, who are turning to ever-more sophisticated methods, which can be hard to spot.

There are, however, common-sense steps you can take to help protect yourself falling victim to an investment or pension scam.

Ways to protect yourself

Financial fraud can take many forms and often start with an unsolicited contact, via a call or text message, or on social media. So-called Phishing scams appear to come from a legitimate source, such as H M Revenue & Customs, Amazon, PayPal or a bank, suggesting you may be entitled to a refund, or have tax to pay. Scammers may also make unwanted calls, purporting to be from a legitimate organisation, to get you to part with your personal details.

You should always treat any unsolicited contact with suspicion. If you’ve been called by someone claiming to be from your bank or another financial institution, end the call and then phone the company back, ideally from another phone. This is important, as scammers can keep the line open if you call back from the same phone. You should never disclose passwords, PIN numbers or bank details over the telephone. Likewise, think carefully before you click on a link contained within a text message or email, as this could direct you to the scammer’s website, rather than the genuine site. If in doubt, visit the legitimate website directly, instead of clicking on a link.

The worrying rise of investment scams

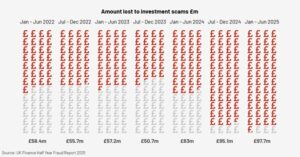

According to the UK Finance Fraud Report, the amount of money lost to investment scams alone increased to £97.7m in the first six months of 2025. These grim statistics are a timely reminder of the need to remain vigilant against investment fraud. Victims of investment scams may not only face financial consequences – becoming a victim of financial fraud can also lead to considerable emotional and psychological harm.

Investment scammers are increasingly turning to social media to carry out their crimes. Advertisements and pop-ups offering high or guaranteed investment returns are becoming increasingly commonplace, as is the use of fake celebrity endorsements, which aim to lend a sense of credibility to the scam.

Many of these scams involve cryptocurrency, but may also feature precious metal investments, or mainstream stocks and shares. Such schemes often guarantee high returns with little risk and sometimes suggest an investment opportunity is only available for a limited period, creating a sense of urgency for the victim to act. It is important not to feel rushed into making a financial decision and always take time to think about whether to take up an offer. This will give you time to seek independent advice before reaching a decision.

Another tactic used by criminals is to create an investment website that looks very similar to an established brand or service. Such “cloned” websites are cleverly designed to fool the user into thinking they are dealing with a legitimate firm. The Financial Conduct Authority (FCA) maintains a list of “cloned” firms on their website, where you can check whether a fake firm has been previously reported for setting up a fraudulent operation that uses the name, address or other details of a legitimate firm.

Pension scams

Scams involving pensions are also becoming more prevalent. According to Action Fraud, total losses from pension scams in 2024 exceeded £17m, with the average victim losing over £34,000. Pension scams often involve the use of fake websites, or cold calls, and attempt to get the individual to transfer their pension savings with the promise of high returns, often using unregulated investments such as overseas property or a high-risk venture in the UK.

Other pensions scams involve the promise of early access to pension savings. The earliest you can access pension savings in the UK is age 55 (rising to 57 from 2028), and earlier access is only possible under strict conditions such as serious ill-health or a terminal diagnosis with a life expectancy of less than 12 months. So-called “pension liberation” scams falsely claim that you can access your pension savings before the age of 55, and victims not only often lose their pension savings, but become liable to significant tax penalties.

Check if it’s real, before you seal the deal

You can help protect yourself from investment fraud by checking who you are dealing with. The FCA Financial Services Register lists details of firms and individuals who are authorised to provide investment and pension advice. To increase awareness, the FCA recently launched a nationwide campaign under the banner “Check if it’s real, before you seal the deal”, using television, radio and media advertisements.

Trust your instincts

There are simple steps you can take to avoid falling victim to an investment scam. Any unsolicited contact from a financial services provider or other organisation should be treated with a high degree of suspicion. Take time to consider any action carefully and don’t feel rushed into making a decision to part with your funds or financial information. Furthermore, be very wary of online adverts offering the promise of high returns. Trust your instincts, and if something seems suspicious, report it to Action Fraud, the UK’s national reporting centre for fraud and cybercrime.