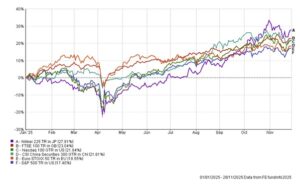

After enjoying a positive year in 2024, investors would have been wise to expect more volatile conditions in 2025. Despite periods of significant uncertainty, major asset classes have produced strong returns over the year to date, with global stock market indices standing close to all-time highs at the time of writing. Fixed interest investments have enjoyed a strong year too, buoyed by expectations of continued monetary easing. In the final Wealth Matters of 2025, we consider the factors that have contributed to the strong performance.

Rallying markets

2025 got off to a slow start. January saw market jitters over the release of an Artificial Intelligence (AI) model by Chinese firm DeepSeek, which led to sharp falls in the value of leading US tech names. The announcement of sweeping tariffs by the US administration in April led to a sharp global sell-off, as investors grappled to understand the implications for the global economic outlook. Market volatility rose to the highest level since the peak of the Covid-19 pandemic but quickly subsided following more conciliatory noises from Washington.

The second half of the year has seen a rally in virtually all asset classes, with global equity indices buoyed by strong earnings reports from US tech giants, and investor hope that the AI boom will see companies continue to beat profit expectations. Investment in AI has been a major contributor to US economic growth over the last 12 months, although the weakness elsewhere increases the risk that a small deceleration in the outlook for AI profitability could lead to weaker economic growth in the medium term.

Investors also remain confident that the Federal Reserve will continue to cut interest rates, as the US labour market cools. Federal Reserve chair Jerome Powell, who has successfully steered the US economy through choppy waters, steps down from his role in May 2026, with his replacement likely to be sympathetic to President Trump’s desire to see significantly lower interest rates. Such a move is risky and may cause inflationary pressure to build once again.

Away from the US, Japan’s Nikkei 225 index broke through the 50,000 barrier for the first time, and Chinese markets also outperformed. European stocks also ended the year higher, with strong global demand feeding into the performance of the FTSE100.

Greater polarisation

2025 has been a year where global markets have become even more polarised, given the rapid increase in market capitalisation of global tech giants. The combined market capitalisation of Nvidia, Apple and Microsoft now stands at over $12 trillion, over four times larger than the combined value of all one hundred constituents of the FTSE100. The size and market weight held by a handful of companies simply increases the risk of a pronounced reversal in global indices should one or more of the biggest US stocks fail to meet sky high earnings expectations.

The last 12 months has seen a clear division between those sectors that have outperformed and those that have lagged. Apart from Technology, Industrials – particularly those involved in the manufacture of defence equipment – have seen surging order books on the back of increased defence spending commitments and infrastructure projects. Banks have also been well-supported, and increases in commodity prices have boosted the Mining sector.

Consumer-related stocks have been overlooked over the course of 2025. The US is experiencing “K” shaped economic growth, with the gap between the financial prospects for higher earners, and those on middle and lower incomes, widening. This disparity has not been helped by the longest-ever US government shutdown that started in October and lasted 43 days. Property related stocks have also struggled to gain traction, and pharmaceuticals have continued their underperformance, as regulatory headwinds remain. As always, sector underperformance can present opportunities where stocks carry lower ratings.

Geopolitical influence

Although it may have been a quieter year for politics than 2024, when major elections were held in the US, UK and elsewhere, markets have continued to grapple with political influence in the form of decisions taken by the US administration. The imposition of tariffs was the primary cause of market uncertainty earlier in the year, and we expect tariffs to return to the headlines in coming months, as the US has yet to finalise deals with its’ major trading partners. Furthermore, the US Supreme Court will shortly rule on the legality of the broad tariff programme, which could derail plans by the White House.

Tensions in the Middle East may have subsided at present; however, significant distance remains between Ukraine and Russia in their attempts to reach a peace deal. Markets remain susceptible to any heightening of tensions in the region, which could damage investor confidence.

Not just equities

Equity markets have not been alone in enjoying a positive 2025; investors in fixed income have seen a year where returns have been consistent, amidst a backdrop of global monetary easing. Government debt to Gross Domestic Product (GDP) ratios continue to expand; however, corporate balance sheets look comparatively healthy, with default rates amongst investment grade debt standing at historically low levels. For those holding diversified portfolios, the smooth performance curve of fixed income over the course of the year has served to reduce equity volatility, which was more apparent in the first half of 2025.

Seasons Greetings

As 2025 draws to a close, we look forward to a year that may present investors with greater challenges but remains full of opportunity. Our first Wealth Matters of 2026 will set out our thoughts on the key themes for the coming year. We take this opportunity of wishing our readers a Happy Christmas and a healthy and prosperous 2026.