Prudent investment advice and management have been the cornerstone of the service FAS have provided clients for more than 30 years. Our advisory proposition, where bespoke investment portfolios are created to suit individual clients’ needs and objectives, has been developed and refined over decades, with the same principles providing the foundation for the range of CDI discretionary managed portfolios. These portfolios are exclusively available to clients of FAS/MGFP and have proved a popular solution for individuals, trustees and businesses alike.

As we will shortly be approaching the seventh anniversary of the inception of the CDI discretionary managed portfolios, we thought we would take this opportunity to look at how the FAS Investment Committee process continues to evolve and highlight the strong and consistent performance achieved by the CDI portfolio range.

Attention to detail

When first designing the CDI discretionary managed service, the FAS Investment Committee wanted to ensure that the years of experience managing advisory funds with a conviction-based approach carried through to the new discretionary mandates. The portfolios are still constructed using the same FAS investment process, which has been constantly refined over recent years to improve the access to available fund research and data mining capability. The frequency of fund manager meetings has also increased, with targeted sessions arranged with leading fund managers, where performance, portfolio structure, risk and market outlook is discussed.

In addition to seeking strong performance, the FAS Investment Committee have continued to focus on driving down the cost of the CDI portfolios. This has been achieved through careful fund and asset selection, together with the result of negotiations with leading fund houses to secure access to lower cost share classes. We will continue to work with fund managers and platforms to deliver the most cost-effective solution to our clients.

Consistent outperformance

The FAS Investment Committee regularly review the performance of the CDI portfolios and run comparison reports against funds within the sector benchmark every week. The Investment Committee use the Investment Association (IA) 0-35%, 20-60% and 40-85% mixed investment sectors as fair benchmarks against which to consider the performance of the Defensive, Balanced and Progressive mandates respectively. For the Adventurous portfolio, the IA Global sector is used. Reviewing the performance of the CDI portfolios against our peers is a vital part of our process and helps clients consider how their portfolio has performed against real world returns at a similar level of risk to their own portfolio.

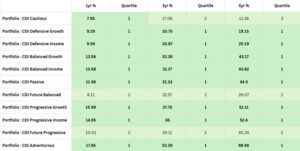

Performance across the CDI portfolio range over the last year has been impressive, largely due to the FAS Investment Committee’s commitment to seeking the very best actively managed funds, coupled with cost effective passive exposure. Over the year to 22nd September, nine of the eleven CDI mandates stand in the first quartile when compared to the components of the representative benchmark index, with seven portfolios ranking in the first decile.

Whilst the short-term performance has been impressive, the CDI portfolio range also ranks highly against sector benchmarks over the longer term. Over the period from 22nd September 2022 to 22nd September 2025, eight out of the eleven CDI portfolios rank in the first quartile with the other three portfolios also comfortably beating their respective benchmark. Looking back further, five-year performance is similarly impressive, with eight portfolios again standing in the first quartile of performance against the sector benchmark.

Source of statistics: FE Analytics, September 2025

Risk Adjusted Returns

Naturally, performance is the key metric on which we, and of course our clients, will focus; however, the level of risk taken to achieve returns is equally important. The FAS Investment Committee consider levels of volatility at each quarterly review stage, to ensure that they remain consistent with the levels displayed by the benchmark. Where changes are made to the portfolio each quarter, the impact of the change on the historic maximum drawdown and value at risk is carefully considered.

Each CDI portfolio has a specific maximum allocation to equities, and current allocations within each portfolio are regularly monitored to ensure the asset allocation boundaries are not breached. Diversification is also carefully reviewed to ensure that any one mandate does not become overly exposed to a handful of sectors.

An evolving process

The performance of the CDI portfolio range continues to impress, and rank highly amongst sector peers. Market conditions will, of course, vary from time to time, and after a very strong period for returns from both equities and bonds, the FAS Investment Committee remain vigilant to potential risks facing the global economy and equity valuations.

Whilst the FAS Investment Committee are naturally pleased with the returns achieved since the inception of the CDI portfolios, they are very aware of the need to avoid complacency at all costs. The FAS Investment Committee will ensure that the investment process continues to evolve to meet the challenges of today’s markets and the needs and objectives of our clients.

If you hold an advisory or discretionary portfolio managed by another firm, perhaps now is the time to review the service you receive, and the performance achieved. Our experienced independent advisers can carry out an unbiased review of an existing portfolio and undertake detailed analysis of performance, risk and charges.

Speak to one of the team to discuss how the CDI discretionary managed portfolios, or our advisory services, could provide a cost-effective investment solution.