As announced in the 2024 Budget, from 6th April 2027, the value of most death benefits and unused pension funds held at date of death will form part of an individual’s estate for Inheritance Tax (IHT) purposes.

The draft rules are in stark contrast to the tax-advantaged position that currently applies. At present, unused pension funds, or remaining pension funds held in Flexi-Access Drawdown, can be passed to beneficiaries at the discretion of the pension trustees, outside of their estate for IHT purposes. This effectively allows the passing of unused pensions through generations and is an effective estate planning tool.

The first round of industry consultation following the 2024 Budget has now concluded. Further consultation is ongoing, although there is little chance of any substantive change to the draft legislation from this point. Those holding unused pension funds should, therefore, take the opportunity to review their position to determine whether any action is necessary in advance of April 2027.

Spousal exemption

The first round of consultation confirmed that pension benefits paid to a spouse or civil partner will remain exempt from IHT; however, just as is currently the case with assets other than pensions, a liability to IHT may arise on the second of a married couple to pass. This exemption does not apply to unmarried partners and could lead to an unexpected liability to IHT in the event of death of an unmarried individual, whose estate would not benefit from the usual spousal exemptions.

The draft legislation has further clarified the rules on Death in Service payments, which will also remain exempt from IHT from April 2027.

Potential 67% tax charge on inherited pensions

Not only will unused pension fund death benefits be subject to IHT, the existing tax rules for those also drawing death benefits from a beneficiary’s drawdown pot will remain in place. If the pension holder dies before the age of 75, whilst IHT could apply depending on the value of the estate, the beneficiary of pension benefits can draw down on the inherited pot without income tax applying to the payments.

The situation is different where a pension holder dies after the age of 75, as the beneficiary is taxed at their marginal rate of income tax on monies drawn from the pension. From April 2027, the value of the pension could potentially be subject to IHT at 40%, and funds drawn from the inherited pension could then also be subject to income tax up to 45% in the hands of the beneficiary.

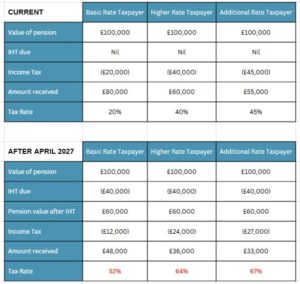

Take the following example, which assumes you were to inherit a pension pot valued at £100,000 from someone who died after the age of 75, and all available nil-rate bands for IHT have already been used. The table shows the position where a beneficiary is either a Basic, Higher or Additional Rate Taxpayer, and in the case of Basic and Higher Rate taxpayers, the pension funds withdrawn are within the respective tax bands.

The above examples do not consider the potential impact of an additional tax liability if the Main Residence Band – which applies if you leave a property to your children or grandchildren – becomes tapered. This occurs for estates valued at between £2m and £2.35m for an individual or £2.7m for a married couple. In this instance, the effective rate of tax payable by an additional rate taxpayer, who receives pension death benefits, could reach 87%.

Clarification for Personal Representatives

The original proposals gave pension scheme administrators significant reporting and payment responsibilities, but following the first round of consultation, the responsibility to account and pay the correct amount of IHT falls on the Personal Representatives dealing with the estate.

Personal Representatives will need to contact the pension scheme to ascertain the value of the pension for reporting purposes, and pension scheme administrators will need to provide this within four weeks of a request. If IHT is due, Personal Representatives will need to calculate the IHT liability attributable to each pension and notify the pension scheme and beneficiaries.

Where the pension death benefits are free of IHT, either by virtue of spousal exemption or where the total value of the estate including pensions is below the Nil Rate Bands, pension trustees can pay benefits without delay.

If IHT is due, Personal Representatives can ask the pension scheme to pay tax directly to HMRC to settle the IHT liability, or they can pay the IHT due from other assets within the estate.

Despite this clarification, dealing with an estate containing unused pensions will become significantly more challenging after April 2027, and given the added complexity, it may well be worth considering who is appointed as Executor of your Will. Of course, Executors could seek professional legal and financial advice in dealing with aspects of an estate in relation to pensions.

Consider the impact of the new rules

For those with unused pension funds, now is the time to review pension values to determine whether the change in rules will alter the potential IHT liability on your estate from April 2027. If so, action can be taken to mitigate the additional IHT that could become payable. For example, you could consider taking benefits from a pension and gifting the Tax-free Cash element, drawing additional pension income and making gifts out of surplus income, or purchase an annuity.

As the pension value will simply be treated as another asset from April 2027, you could also consider planning with other assets held outside of a pension, which could be structured to reduce the impact of IHT. The most appropriate solution will depend on the precise composition of assets held, family circumstances and financial objectives. This is why seeking bespoke and tailored financial planning advice will be key to adopting an effective strategy.

The advisers at FAS always take a holistic approach to financial planning. We look at a wide range of aspects of an individual’s financial position, and as an independent firm, we can consider solutions from across the marketplace without restriction. If you have questions relating to the changes to pension death benefits, speak to one of our experienced advisers who will be happy to help.