Many turn to accumulated savings as a way of generating an income. Those in retirement may use savings interest to supplement state and workplace pension income. Others may use deposit interest earned to fund discretionary spending. Whatever the reason, savers may well have been pleased with the interest received on deposits over the last two years, which are a far cry from the meagre returns paid to savers during much of the last decade.

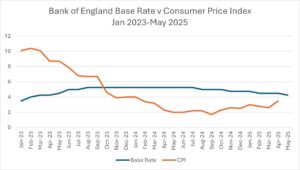

A mistake that is commonly made is the assumption that cash savings are risk-free. It is true that the balance on a savings account does not fluctuate in value, unless funds are added or withdrawn; however, the hidden risk in holding cash is the eroding impact of inflation. Last year provided something of an historic anomaly, as the Bank of England base rate regularly exceeded the prevailing rate of Consumer Price Index (CPI) inflation, meaning that savers enjoyed a brief period when deposits provided a positive real return.

This brief period of positive real returns may, however, be ending. The Bank of England cut the base interest rate to 4.25% in May, the fourth cut in less than a year, and further cuts are expected over the coming twelve months. This is despite the sharp uptick in CPI in April, which saw a jump to 3.5%, although we expect inflation numbers to ease later this year as economic growth slows once again.

The pace and timing of future action by the Bank of England Monetary Policy Committee will depend on how the UK economy fares in the face of a higher overall tax burden, the ongoing threat of tariffs and consumer confidence. The trend for base rates is, however, now firmly downward.

Diversify away from cash

Naturally, everyone should aim to keep a sensible balance on cash deposit, to meet everyday costs and unexpected contingencies; however, given the likely trajectory for UK base rates over the coming year, those with larger deposits should take the opportunity to consider alternatives that could provide a sustainable level of income, without taking excessive levels of risk.

The first alternative to consider are fixed income investments. When a government or company wishes to finance their ongoing debt obligations, they often do so by issuing a loan note. In the case of government debt, these are known as Gilts in the UK, or Treasury Bonds in the US. Company debt is often labelled as a Corporate Bond. Most loans have a similar structure, whereby the issuer pays regular interest, at set intervals, and at the maturity of the loan, repays the principal of the loan to the lender. This predictable income stream makes government and Corporate Bonds an ideal method of generating a sustainable income.

Investors should, however, be aware that bond prices fluctuate on a day-to-day basis according to underlying market conditions and can also be influenced by the perceived financial strength of the issuer. In the event of a bond issuer failing to repay the interest or principal at maturity, the bond is said to be in default, whereby losses can occur.

Bond prices are also influenced by expected levels of inflation, and interest rate expectations. This is particularly true for longer dated bonds, which tend to be more volatile than short-dated issues, where the proximity of the maturity date increases the predictability of returns. By focusing a fixed income strategy on bonds with shorter maturities, attractive levels of income can be achieved with low levels of volatility.

The second alternative to cash deposit are equities (company shares). Part of the return from holding equities are regular distributions of excess profits which are paid to shareholders in the form of dividends. Many companies have a strong track record of dividend payment and a company that enjoys a robust performance may well look to increase its’ dividend payment over time, which could potentially offset the effects of inflation.

Dividends are, however, not guaranteed, and changes in the fortunes of the company in which shares are held can not only impact the share price, but also the potential for dividend growth. Indeed, a company that begins to struggle may look to cut its’ dividend or cancel it altogether.

The importance of advice

Those who rely on a sustainable level of income should review their cash deposits and potentially seek to diversify surplus funds into alternatives, such as fixed interest securities or equities. It is, however, important to seek impartial advice before considering employing cash savings elsewhere in the pursuit of an income stream.

Firstly, the time horizon for investment needs to be evaluated. Both bonds and equities are designed to be held for the longer term (i.e. at least a period of five years) as holding risk assets over a shorter period only increases the investment risk. The second important consideration is to ensure that you are comfortable with the volatility that will be encountered when moving away from cash deposits. For those used to seeing a static balance on a savings account, adverse movements in bond or stock prices may be unsettling in the initial stages of an investment strategy.

The benefits of taking a holistic approach

The risks of diversifying away from cash deposit can be reduced by building an appropriate and well diversified portfolio, which is tailor-made to suit your requirements. At FAS, we recommend the use of collective investments, which invest in a wide range of different individual positions (thus avoiding stock specific risk) and blend a number of these collectives to achieve further diversification.

As we adopt a holistic approach to financial planning, we will also take into consideration the appropriate level of funds that should remain on deposit and ensure that these deposits remain productive. We will also look to maximise the tax-efficiency of any portfolio strategy.

If you are holding surplus cash deposits and wish to generate an attractive level of sustainable income, then speak to one of our experienced advisers.