Changing travel money for holidays abroad may be the only direct interaction many will have with currency exchange rates on a day-to-day basis; however, exchange rates between currencies have far reaching implications for investment markets, the prospects for the global economy and our financial prosperity.

How currency movements affect performance

When investing in overseas assets, currency fluctuations can significantly affect your investment returns. In addition, domestic investors are also impacted by exchange rate movements due to the global nature of supply chains and revenue streams.

One of the most direct ways exchange rates influence investments is through their effect on returns when converting foreign investments back into the investor’s home currency. Take the following example of a direct purchase of Microsoft Inc Common Stock. At the time of writing each Microsoft share would set you back $477 USD, which at the exchange rate of 1.35 US Dollars to the British Pound, would be £354. Let us assume the share price remains unchanged a year later, at $477 USD; however, over the course of the year, the US Dollar strengthens against the Pound, moving the exchange rate from 1.35 to 1.25 US Dollars to the Pound. In Sterling terms, the value of the investment has increased to £381, despite the share price remaining unchanged. Whilst the example demonstrates a positive currency movement, should the US Dollar have weakened over the course of the year, the investment would have lost money when converted back to Sterling.

Exchange rates affect investments in multinational companies listed in an investor’s home country; however, we live in a global marketplace, and multi-national firms generate revenue from multiple currencies. Continuing to use Microsoft as an example, the company earns a substantial proportion of its revenue from abroad. If the US dollar shows strength against other currencies, this can reduce the value of the overseas earnings generated by Microsoft when they are converted back into dollars, which can affect profitability. Conversely, if the US dollar weakened against other currencies, this can help boost Microsoft’s earnings, which would potentially lead to an upward rating in the value of the company.

The factors behind currency movements

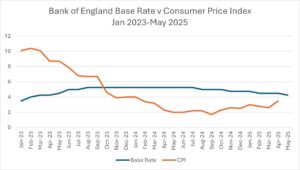

Exchange rates are influenced by a range of factors, although two of the most important considerations are prevailing and expected interest rates and levels of inflation. A country with a higher interest rate than its’ peers may attract more foreign capital, increasing demand for their currency. This can make investments in those countries more attractive. Higher levels of inflation have the opposite effect, as it can erode the real value of currency and deter investment.

Government policy decisions can also have an impact on currency stability. Elevated levels of Government debt can cause currency values to fall as investors become wary of a nation’s financial stability. For example, the ill-fated Mini Budget of 2022, saw a run on the Pound, and caused a sharp drop in the value of Sterling against the Dollar, so much so that the two currencies briefly came close to parity. Likewise, the Brexit vote in 2016 had a severe impact on the strength of the Pound at the time, and in turn damaged investor confidence.

“Safe haven” currencies?

The strength or otherwise of the US Dollar plays a pivotal role in the outlook for the global economy and the price we pay for goods in the UK. Commodities such as oil, gold, and copper are priced in U.S. dollars, and therefore movement in the US currency has a direct impact on the cost of these commodities locally and further influences the cost of goods that rely on these raw materials.

The US Dollar has long been considered a pillar of strength and a “safe haven” currency, which investors tend to flock to in times of crisis. This year has seen a change of direction, partly driven by the trade tariffs announced by President Trump in April. This caused the Dollar to slide against a basket of major currencies, as investors digested the impact of trade barriers imposed by the US. Recent events in the Middle East, including the deepening conflict between Israel and Iran, would ordinarily have led to the Dollar seeing inflows. In recent trading sessions, however, the Dollar Index has barely moved, adding further weight behind the suggestion that the Dollar is beginning to lose its “safe haven” status.

To hedge or not?

Diversifying a portfolio globally is a powerful way of spreading risk across multiple geographic regions. However, this introduces the challenge of managing currency exposure. Truly global investment funds, which invest in several regions and underlying currencies, can minimise the impact of currency movements on fund performance, as different currency positions held function as a hedge against each other. In addition, some investment funds actively undertake hedging strategies to reduce the impact of currency risk. This is particularly the case for fixed income investments, where fund managers are seeking income and stability without the added volatility of currency movements. Whilst hedging can provide downside protection from adverse currency movements, it may also limit potential gains, and therefore the decision to hedge currency risk will be determined by the composition and objectives of the investment fund in question.

Another layer of complexity

When choosing an investment strategy, currency risk adds another layer to the decision-making process and is a risk that some investors choose to ignore. This can, however, lead to underperformance, and increased volatility, particularly in today’s global markets. Our experienced advisers can review existing investment portfolios and assess the level of currency risk to which you are exposed. Speak to one of the team to start a conversation.