Ethical investment strategies have seen significant growth over recent years, as more investors aim to align investments with their own values. According to data from Morningstar, total assets in global sustainable funds have climbed to US$3.2 trillion at the end of 2024, almost double the total assets held in similar funds at the end of 2020.

Whilst returns from socially responsible investment strategies have been strong over the longer term, recent performance has lagged unfiltered investment approaches. This underperformance is one reason for the slowing demand for socially responsible strategies.

Playing catch-up

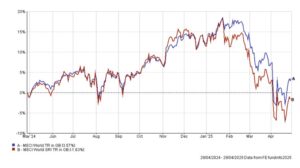

Those who wish to invest with an ethical stance have enjoyed returns over the medium and long term which have closely matched the returns from wider markets. Over recent months, however, this has not been the case. After seeing strong growth in 2024, largely due to the allocation to technology within ethical funds, socially responsible investment strategies have lagged more inclusive investment approaches since the start of the year. The chart below shows the widening gap between the MSCI World Index (shown in blue), and the MSCI World SRI Index, which excludes companies whose products have negative social or environmental impacts (shown in red), over the last 12 months.

The disparity in performance is the first significant divergence seen between the two MSCI indices over the last five years and clearly demonstrates the additional “cost” that ethical investors are currently paying to invest in line with their values.

MSCI World vs MSCI World SRI indices, Total Return in GBP over 12 months. Source FE Analytics April 2025

MSCI World vs MSCI World SRI indices, Total Return in GBP over 12 months. Source FE Analytics April 2025

The underperformance can be attributed to the sector rotation we have seen over the last three months, due to global events. The decisions taken by European nations to increase defence spending has seen the Aerospace and Defence sectors grow strongly, as investors anticipate the potential profits that could be generated from growing order books. Socially responsible strategies are likely to hold a very limited exposure to these sectors.

Energy stocks have also performed well in the first quarter of 2025, producing the strongest performance of any sector within the S&P500 index, spurred on by a shift in policy from the US administration towards oil and gas production. This contrasts with the performance of renewables related stocks over the same period.

The underperformance of Technology has also been a major detractor that has hindered ethical investment strategies. After an extended period of growth, investor confidence in the major US Tech players has cooled due to concerns over the impact of tariffs and Chinese advances in Artificial Intelligence (AI).

Finally, the new Trump administration has clearly set out plans that fail to align with the green agenda and climate goals. This has led investors to question whether the change of direction could lead to continued underperformance.

Strong headwinds

The weaker returns achieved from ethical investments over recent months is likely to be a key reason behind the significant outflows seen from ethical investment funds over the last quarter. According to Morningstar research, more money was withdrawn from ethical strategies globally than invested, and new fund launches also fell to their lowest point in three years, reflecting the weaker investor demand.

Recent performance is not, however, the only reason ethical investments are facing strong headwinds in the current market conditions. Tighter regulation of sustainable investments has seen Europe, and the UK introduce new regulatory frameworks, designed to reduce the potential for “greenwashing”, i.e. misleading marketing that makes an exaggerated or false claim about the environmental impact of an investment.

In the UK, the Sustainability Disclosure Requirements (SDR) came into force last year, which encouraged funds to apply for a sustainable label, and for funds that choose not to apply for a label, to tighten up naming conventions. Take-up of the new labels has been slow, with just 94 funds adopting one of the SDR sustainability labels by April 2025. This is due to the rigorous scrutiny of the investment approach by regulators. As a result, a much greater number of funds have chosen to change name, more closely reflecting the strategy of the fund, or have decided to drop a sustainable investment approach altogether.

Whilst the slowdown in fund launches is a concern to asset managers, there remains a wide choice of both active and passive investment funds available for those who wish to invest ethically. Sustained weaker performance and diminishing investor appetite could, however, lead some fund managers to ditch their ethical stance, or in the case of smaller funds, merge or close investment strategies.

Where next for Ethical investments?

Socially responsible investment has taken significant leaps forward over recent years in terms of popularity and the availability of both actively managed and index tracking funds. Whilst ethical investors have seen returns closely match mainstream investment strategies over the longer term, the recent underperformance will no doubt be of concern to some who prefer to invest ethically. This could potentially have wider implications for continued growth in the ethical investment space.

At FAS, we have two distinct approaches to cater for those who wish to incorporate ethical considerations into their investment approach. Through CDI, our discretionary managed portfolio service, we offer two strategies that take a common-sense approach to socially responsible investment, that are designed to meet suitable screening criteria (which limits exposure to areas such as fossil fuels, gambling, animal testing and weaponry) whilst being as inclusive as possible.

We also appreciate some investors would prefer a more focused ethical investment approach. Here, we can build bespoke advisory investment portfolios, using rigorous quantitative screening processes and active engagement with leading fund managers, to meet a client’s ethical preferences.

Speak to one of our experienced financial planners to discuss existing investments you hold, or if you wish to invest in a socially responsible manner.