New clients to FAS often agree to transfer existing investment portfolios they hold with discretionary fund managers, to our management. As a result, the advisers at FAS regularly have the opportunity to review the performance, management style and charging structure of what we would term “traditional” discretionary fund management services, from some of the biggest names in the industry.

As you might expect, our analysis produces some variances in results, depending on the fund manager employed. There is, however, sufficient commonality across a range of different discretionary fund managers to draw meaningful conclusions and reinforces the need to regularly review the investment performance and costs of any discretionary managed service.

Investment selection

When we review investment portfolios managed by other discretionary fund managers, we do so in an objective and unbiased manner. We have the mantra that if performance is consistent, and the portfolio volatility and risk match the objectives of the client, it may be best to take limited action. We do, however, notice a series of trends emerging from our ongoing analysis, which suggests that many of the largest UK discretionary managers adopt a very similar approach to each other, leading us to question whether the blend of investments held within portfolios really suits the client circumstances.

Firstly, many discretionary managers choose to directly purchase Gilts (UK Government Bonds), to form part of their fixed income exposure within a portfolio. Whilst Gilts do have an advantage in terms of their Capital Gains Tax treatment over collective investments holding a wider range of bond positions, we feel the focus on UK Government debt can miss out of the potential for superior returns from good quality corporate bond alternatives.

The second common theme we have identified is the use of investment funds domiciled outside of the UK. These funds often carry higher charges, which push up the overall cost of ownership, and potentially limit returns. There is a myriad of investment options available to UK investors that are UK domiciled, which remain significantly more popular to UK investors than those domiciled overseas. Indeed, the Investment Association produced data at the end of 2024 that showed that 83% of collective funds held by UK investors were held in funds domiciled in the UK. It could be that the common use of an overseas fund is a case of loyalty to a particular boutique fund house that the firm has used for many years; however, given the breadth of choice available within UK domiciled funds, we question the effectiveness of this apparently common trend.

Finally, we note the quantity of holdings that tend to be present within traditional discretionary managed portfolios. We often see portfolios with upwards of 25 or 30 different holdings, which we feel can cloud performance by spreading the portfolio allocation too thinly to good performing funds. Diversification is, of course, an important factor in risk mitigation; however, we would argue that this can be successfully achieved with a more compact and well organised portfolio.

Investment style and charges

We have often commented on our view of the blend of active and passive investment funds that we prefer to see within a well diversified portfolio. Passive funds dominate industry fund sales, and for good reason, as they provide wide exposure through a particular index with low costs. Our analysis shows that where passive investment styles are ideal for some markets, they are less than optimal for others.

Actively managed funds can provide additional returns over and above the target index, by adopting a more concentrated approach. Strong performance from an active manager can easily justify the additional costs associated with active management, which can be 10 or 15 times higher than an index tracking fund investing in the same sector or region. Conversely, weak active management can lead to underperformance of wider indices, with associated higher charges.

Through our analysis of traditional discretionary managed portfolio services, we note that the bias tends to be heavily weighted to active funds, with only limited exposure to passives. As a result, the blended portfolio cost may well be higher than average. Whilst cost and value should not be conflated, where performance is also modest, we have found clients with other discretionary managers are often paying more than they should, for less than stellar returns.

Absence of wider financial planning

Using a discretionary fund manager may ensure that your investments are reviewed and changed at regular intervals. The function of regular rebalancing and risk adjustment is a key component of any sensible investment approach – leaving investments in place without review for an extended period is unlikely to produce good results over the longer term.

The review carried out by a discretionary fund manager may, however, only extend to the funds themselves, and save for use of the annual Individual Savings Account (ISA) allowance, there may be little scope for wider financial planning.

This is not the fault of the discretionary manager. Their remit is to manage a portfolio of funds; however, this function only forms part of a bigger financial puzzle for most client circumstances. This is where an independent and holistic firm, such as FAS, can add significant value, by undertaking a full and comprehensive financial review, providing advice on multiple tax wrappers (such as Pensions and Investment Bonds), esoteric investments such as Venture Capital Trusts and Inheritance Tax solutions and other associated areas, for example protection policies.

The importance of critical review

Given the many examples we have noted, anyone using a discretionary fund manager should regularly undertake a critical review of the service they are receiving. Investors should question the investment performance, both on an absolute and relative basis compared to peers, and the costs and charges of the service. At FAS, we can undertake an impartial review of an existing investment strategy and undertake additional key analysis, looking at areas such as risk and volatility, which can be difficult to assess without expert advice. Speak to one of our experienced advisers to discuss your existing discretionary manager.

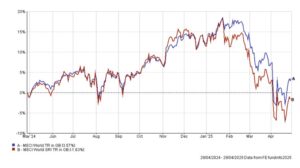

MSCI World vs MSCI World SRI indices, Total Return in GBP over 12 months. Source FE Analytics April 2025

MSCI World vs MSCI World SRI indices, Total Return in GBP over 12 months. Source FE Analytics April 2025