Investment market sentiment has been fragile since the “Liberation Day” announcements by President Trump on 2nd April. The imposition of tariffs by the US, and retaliatory measures taken by trading partners, threatens to change the dynamics of global trade and the outlook for the global economy. Market volatility has increased significantly, as investors try to understand the implications for equities markets. In short, it has been an uncomfortable time to be invested in global equities.

In times when market volatility spikes, it is important to remain focused on the long-term trend, and to try and avoid taking short-term decisions that could prove detrimental to your financial well-being. History tells us that the initial knee-jerk reaction to global events, such as those invoked by the US administration currently, are often short lived. This may be even more pertinent to the current tariff-induced volatility, where policy decisions taken by the Trump administration reverse quickly and lead to a rapid rebound in stock values.

Bumps in the road are more common than you might think

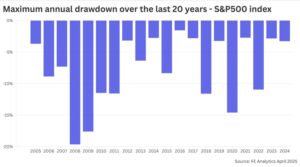

It is important to recognise that periods of high market volatility are commonplace when we look back over recent history. The chart below shows the maximum drawdown – i.e. the largest move from peak to trough – in the S&P500 index of leading US shares, in each of the last 20 calendar years, from 2005 to 2024. As you can see from the chart, maximum drawdowns of more than 10% have occurred in seven of the last 20 years.

There have been specific factors behind each of the major drawdowns of the last two decades. The “Great Financial Crisis” of 2008-9 was the longest and most painful downturn of recent times. Caused by the failure of US lenders and the bursting of a US housing bubble, the fallout caused a global recession in 2009. Investors who bought the S&P500 index just before the crisis had to wait almost three years for the index level to rise above their purchase price.

The outbreak of the Covid-19 pandemic created the largest global economic crisis for a generation, as lockdowns caused significant damage to public finances and global commerce.

Investors had nowhere to hide during the early stages of the pandemic, with stock markets around the World moving rapidly lower during March and April 2020. The S&P500 index fell by 29% to the low point on 23rd March 2020, but had recovered the lost ground just four months later.

The Russian invasion of Ukraine in February 2022 led global markets lower, as inflationary pressure rapidly increased and caused investors to re-think economic projections. Despite reacting calmly to the initial outbreak of hostilities, the S&P500 index of leading US stocks moved decisively lower a few weeks later and took just over one year to recover to a higher level than at the start of the Russian invasion.

More historic evidence

Each of the market events listed above caused a short-term re-pricing of risk assets; however, looking back through recent history provides clear evidence that investor pain following a global event is relatively short-lived. Despite the numerous temporary setbacks of the last two decades, the S&P500 index has risen by over 400% since 2005, significantly outstripping returns from other asset classes.

The need to stay invested is supported by historic data over an even longer period. The Barclays Equity Gilt Study has compiled data over more than 130 years and shows the probability of equities providing better returns than those available on cash, over a two-year investment period, is 70%. When a longer time horizon of 10 years is considered, the probability increases to over 90%. Such evidence, gleaned over an extended period, further supports the need to stay invested through periods of uncertainty.

Is this time different?

In some respects, the current bout of market turmoil is different to recent precedents, as much of the volatility has been caused by the policy decisions of the US administration. As we suspected, Trump’s actions may well be short-lived. Countries are highly likely to negotiate deals with the US administration, dampening the direct impact of tariffs. A baseline 10% tariff will cause little in the way of lasting damage to the global economy. Nations may take the imposition of tariffs as an opportunity to change trading habits to form new trading alliances to circumvent the tariff charges. Finally, Trump’s actions are not without consequences, as demonstrated by the weakness in US Treasury Bond market, and concern amongst Republican party members.

Trying to tactically move to cash, to avoid the downturn, or selling out temporarily in the hope of buying investments back at a cheaper price may sound an attractive proposition; however, such decisions are rarely successful and rely more on luck than judgement, as you may find that markets have already moved higher when you look to re-enter markets, leading to a worse outcome than would be the case by staying invested. This is particularly the case when considering the current volatility, as demonstrated by the initial market reaction to the climb down by the Trump administration.

Keep the long-term view in mind

It is important to keep your longer-term objectives in mind when dealing with turbulent markets. Equity markets are inherently volatile, and from time to time, global events push risk levels higher. Of course, we cannot predict the future, but we can learn lessons from the market’s reaction to past events.

Engaging with an independent financial adviser during periods of volatility can prove invaluable. Our advisers are experienced and can help provide reassurance during periods of market turbulence and review your personal arrangements to provide peace of mind in challenging markets. Speak to one of our friendly team to start a conversation.