It is now a decade since George Osborne introduced legislation under the title of Pension “Freedom and Choice”. The rules, which were introduced in April 2015, gave people aged 55 and over more flexibility about when and how they draw their Defined Contribution pension savings.

Increased popularity

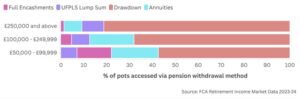

Flexi-Access Drawdown, which was introduced under the legislative changes ten years ago, has rapidly become the most popular method of drawing a pension income. Under a Flexi-Access Drawdown approach, the pension holder has complete freedom to draw as much or as little from their pension pot beyond the normal pension age (currently 55) without restriction.

According to data compiled by the Financial Conduct Authority (FCA) in the 2023/24 tax year, 68% of those with pension funds valued between £100,000 and £250,000, who accessed their pension, did so via Flexi-Access Drawdown. Only 19% chose to purchase an annuity, where a guaranteed income for life is bought with the pension fund value. For those with pension values above £250,000, the popularity of Flexi-Access Drawdown is even higher, with 82% of individuals accessing their pensions using this approach.

It is easy to understand why Flexi-Access Drawdown has become such a popular option for those with more substantial pension savings. Adopting a drawdown approach provides the ability to adjust the amount of income drawn to a level that precisely suits the individual and can easily be adjusted to adapt to changes in financial circumstances. For example, the level of drawdown can be increased if additional income is required or reduced if income is not needed.

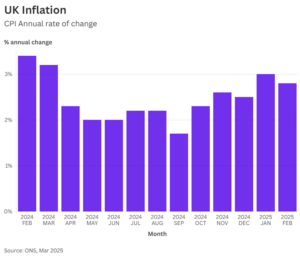

Furthermore, the income stream can be established as monthly payments, or ad hoc lump sums of income can be paid in addition to, or instead, of regular payments. This means that Flexi-Access Drawdown can also be a powerful way of reducing an income tax liability, by adjusting the level of income withdrawn. This is proving particularly useful as Income Tax bands and the Personal Allowance have been frozen since 2021, and the State Pension is increased each year via the “triple lock”.

By adopting a Flexi-Access Drawdown approach, the fund remains invested, providing the opportunity to participate in growth in values over time. As a pension fund remains tax exempt when invested, it allows the accumulated savings to grow in a tax-efficient environment.

A key benefit of Flexi-Access Drawdown is that any remaining pension value held can be passed on to a nominated beneficiary when an individual dies. This contrasts with other options, such as pension annuities, where payments cease on the death of the individual, or their dependent. It is, however, worth remembering that pension death benefit rules are set to change from 2027, when the remaining value of a defined contribution pension will be added to an individual’s estate when Inheritance Tax is calculated.

Not without risks

Whilst it is easy to identify the reasons for the increased popularity of drawdown pensions, it is important to recognise that this approach carries ongoing risks. The most obvious is the potential for the withdrawals to erode or even exhaust the value of the pension, at which point the pension would cease to provide you with an income. The success of a drawdown approach will be measured by whether the rate of withdrawals taken is sustainable, and the long-term investment performance achieved.

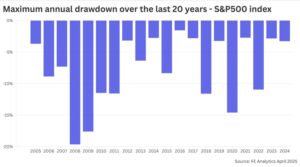

Selecting an unsustainable rate of withdrawal is likely to reduce the value of the pension over time, if investment returns fail to match the level of withdrawal taken. As the pension value falls, the rate of erosion often accelerates, as the rate of return required to offset withdrawals becomes increasingly unrealistic. This effect can be exacerbated by significant movements in global markets, such as those seen during the early stages of the Covid-19 pandemic or at the start of the Russian invasion of Ukraine. If such a market shock occurs in the early stages of a drawdown strategy, this could further reduce the likelihood that the portfolio can meet the required rate of return to match the rate of withdrawal.

Adopting a drawdown approach will mean that a suitable investment portfolio will need to be constructed, and managed, which will incur ongoing costs. Such costs are not present when buying an annuity, due to the absence of an investment fund. It is also crucial that any drawdown retirement strategy is reviewed regularly, to ensure that it continues to meet any changes in circumstances, and the investments remain appropriate given variances in market conditions.

The power of tailored advice

We have often commented in the past that financial decisions taken just before retirement are perhaps the most crucial, as they can have implications for the remainder of an individual’s life. The increased choice offered under the Pension Freedom rules also increased the complexity of the decision-making process, and this remains as true today as it was ten years ago. This is why it is important to seek advice which is tailored to your specific needs, objectives and financial circumstances.

Whilst Flexi-Access Drawdown is clearly the most popular option amongst many approaching retirement, it isn’t right for everyone. Annuities provide a guaranteed income and avoid the need for the ongoing risk and costs of managing pension investments. They do, however, fail to offer the flexibility that a drawdown approach provides, which many find invaluable.

Our experienced advisers can take an independent review of your retirement savings, and thoroughly explore the options with you, so that you can be confident you have made the right decision. Speak to one of the team to start a conversation.