One of the simplest ways of investing for the longer term without committing a lump sum is to regularly invest over a period of time. In fact, many of us do this without thinking, as employer and employee contributions are paid into personal pension plans on a monthly basis via payroll.

Each monthly contribution buys units in an investment fund or strategy, with the quantity of units received from each contribution based on the prevailing price of the selected fund at the time of investment. Since fund prices fluctuate over time, the number of units acquired each month varies accordingly. When markets are performing well, fund prices are generally higher, resulting in fewer units being purchased with each contribution. Conversely, during market downturns, lower fund prices allow investors to buy more units with the same amount of money.

A regular investment approach benefits from a theory known as “Pound Cost Averaging”, which helps smooth out market fluctuations over time. By undertaking regular investment, the purchase price paid will vary from month to month leading to an average entry point over the longer term. This helps smooth out the volatility which is inherent in global equity markets.

Investing regularly can help remove the emotional aspect of the decision on when to invest, which can be particularly helpful during periods when market volatility and risk are elevated. For a long-term investor, the timing of market entry can be less relevant, as investment returns over an extended period are largely dictated by the amount of time an investment is held; however, making the decision to invest in a market downturn can be challenging, particularly for investors who have not experienced such conditions previously.

Regular investment can be a very sensible way of building wealth over the long term. Saving a set amount each month promotes financial discipline and if funds are collected automatically, as is the case with pension contributions, the commitment is made before the funds reach your bank account. The same approach can, however, be used to regularly invest for other financial targets, such as building a sum of money to help children and grandchildren through higher education, or towards a deposit for their first home.

For those without the funds to make a lump sum investment, regular investment into a plan can improve accessibility to investment markets. Most investment plans offer the ability to accept regular savings, which can usually be set up via a direct bank payment each month. Whilst this automates the investment process, it is important to remember that the savings plan can be adapted to reflect changes in circumstances. For example, the amount saved each month could increase as funds allow, or contributions could be temporarily suspended if funds are needed for other financial commitments.

Regular investment with a lump sum

While regular investing is an effective way to build wealth gradually, the same approach can be adopted for those with a lump sum available for investment. Conventional investment wisdom suggests that the longer an investment remains in the market, the greater the potential for growth. A rational investor might, therefore, opt to invest a lump sum immediately to maximize market exposure and potential returns. Historical data supports this strategy, particularly during stable or rising markets.

While investing a lump sum immediately may be beneficial in a rising market, in periods when market volatility is elevated, adopting a regular investment approach may be beneficial. This process is known as “phasing” and divides the lump sum investment into smaller portions which are invested at regular intervals over a set period, such as three, six, or twelve months.

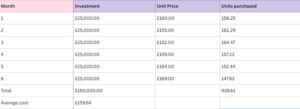

As demonstrated in the example below, an investor with a lump sum of £150,000 to invest could choose to allocate £25,000 per month over six months instead of investing the entire amount upfront. The first payment of £25,000 is made in month one, with the balance of £125,000 being held on cash deposit. Each consecutive month, a further £25,000 is invested until the full investment has been made.

If markets decline during this period (as is the case in the first three months of the example) each investment purchases a greater number of units at lower prices, ultimately enhancing the overall investment position; however, if markets rise steadily, phased investing could lead to fewer units being purchased over time, resulting in a lower return than if the funds are invested immediately. Whilst this would place the investor in a worst position than if the investment was made in one tranche, it would, however, reduce the risk of making the full investment in a single transaction.

Getting the right advice

The decision to phase an investment needs careful consideration of the outlook for investment markets, time horizon for investment, and needs and objectives of the investor. For example, an investor seeking income from an investment may well have to contend with lower natural income in the early stages if an investment is phased, as only a proportion of the investment is committed to the chosen strategy.

Independent financial advice can add significant value in reaching this decision. At FAS, we tailor investment strategies to each client’s unique situation, considering both lump sum and phased approaches where appropriate. If you are looking to establish a regular savings plan, or arranging a lump sum investment, speak to our experienced advisers to discuss the options in more detail.