Amidst an avalanche of news flow over recent weeks, investors are trying to understand the implications of events in the White House in respect of the Russian-Ukraine conflict, and imposition of tariffs by the Trump administration. It is, therefore, not surprising that market volatility has increased. At times such as these, we feel it is important to look beyond the noise, and focus on quantifiable, fundamental factors.

Cutting through the noise

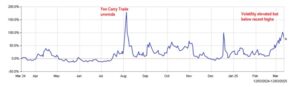

Firstly, it is sensible to put the recent market performance in context. It is important to bear in mind that investment markets have enjoyed an extended period of positive returns and relative calm since October 2023. The only significant spike in volatility over the last 18 months was the brief market hiccup when the Yen carry trade began to unwind in August 2024. The graph below shows the CBOE VIX index, which is a measure of volatility in US markets, and often known as the “fear index”. Whilst volatility is elevated, it remains some way below the levels seen in August 2024 and the early part of this year.

The calm incremental returns seen over the last eighteen months represent a long period of market stability, and increased market volatility is expected as we continue through 2025. Volatility is, however, not only an inevitable element of the investment process – it is also healthy. For example, overvalued stocks may be re-rated during periods of volatility, leading to more attractive valuations and greater investment opportunities.

Factors to consider

Investors are weighing up a range of factors that are exerting an influence on market direction currently. Greater uncertainty is apparent, although there are reasons why investors should remain confident about the medium-term outlook.

The imposition of trade tariffs by the White House may represent a bigger threat to global growth than the geopolitical wranglings between US, Ukraine and Russia. There is, however, some question over how long tariffs would be imposed for, which could limit the damage they could inflict. Any trade barrier is unhelpful, and tariffs imposed for an extended period are likely to hamper global growth, which would extend to countries that are indirectly affected. Tariffs are also inflationary, as prices are driven higher, and consumer confidence may also be affected. Likewise, businesses may well curb expansion plans in this environment.

Broad tariffs have so far been imposed on Canada and Mexico, and specific tariffs on commodities such as steel and aluminium have been introduced over recent weeks. There has already been some pullback from the Trump administration, which introduces further uncertainty over the likely damage tariffs could cause and only adds to the volatility.

US corporate earnings remain strong, and we feel this supports a positive medium-term view. Fourth quarter company earnings in the US have largely exceeded expectations, although companies from a range of sectors have warned that the immediate outlook is less positive.

The broadening of the market rally over recent months can also be viewed as a positive signal. Technology stocks were the spearhead for the growth in the US, which widened the performance gap between growth companies and value stocks last year. This gap has now narrowed, with investors turning their focus to other sectors, with financials, energy and consumer staples outperforming, and defence stocks jumping on the likelihood of increased government spending.

Investors showed considerable confidence throughout 2024, although this is likely to be tested in the short term. The market falls before Christmas, and again in January following the announcement of DeepSeek (the Chinese AI competitor), saw investors buy back in, thus reinforcing the positive mood. It remains to be seen whether investors view the current volatility as a buying opportunity; however, it would be foolish to write off the positive trend. In the words of John Maynard Keynes, “markets can stay irrational far longer than you can stay solvent”.

The final positive factor may be delivered by the Federal Reserve. A slowdown in US growth, and weakening outlook, may lead to the Fed cutting US interest rates perhaps more rapidly than many market commentators expect. Falling interest rates later in 2025 could provide an injection of positivity, and support investor confidence.

Remain focused on the long term

In more volatile market conditions, investors would be well advised to review the composition of their portfolio. They should ensure they have adequate diversification across a range of sectors, geographies and asset classes. Even in the most testing of market circumstances, opportunities always present themselves. For example, bond markets have not been immune to weakness, due to concerns over Government debt levels and the jump in inflation; however, good value can be found within short-dated bonds.

Active equity fund managers can allocate their portfolio to sectors that are performing well and seek value where possible. Where passive funds proved hard to beat in some markets last year, the expected conditions lend themselves well to active fund management. This is why we advocate holding a portfolio that holds both passive funds for broad market exposure, and active funds to drive performance.

We also recommend investors remain invested through any period of volatility, as investment returns are delivered from the length of time invested, rather than timing. Trading market conditions introduces significant risks, and the current uncertainty could lead to a rapid repricing of assets. For example, a ceasefire in Ukraine or the decision to remove tariffs could lead to a marked rally.

Keep a sense of perspective

Looking through the noise and rapidly evolving news flow, and focusing on the fundamentals, can help keep a sense of perspective. Strong corporate earnings, pockets of value amidst sectors left behind by the tech rally of 2024, and a supportive Federal Reserve provide us with confidence that markets can continue to perform well over the medium term. It is, however, clear that short-term risks are somewhat elevated, and external factors, such as trade tariffs and the conflict in Ukraine, could derail confidence in the short term.

Given the changing landscape, it would be sensible to ensure that your portfolio remains under review. Our experienced advisers can take an impartial view of an existing investment portfolio and provide suggestions where changes could be made that are tailored to your needs and attitude to risk. Speak to one of the team to arrange a review of your portfolio.