When choosing a financial adviser, one of the primary decisions is whether to use an independent or restricted firm. Whilst the Financial Conduct Authority require firms to set out their service proposition at the outset, many consumers may not be aware of the difference between the two.

Firms offering an independent advice service, need to be able to recommend all types of retail investment and pension products from firms across the market without restriction. This contrasts with a restricted advice service, which may either be restricted by the type of products they offer, the number of providers they choose from, or both.

Both independent and restricted advisers must have achieved the requisite level of qualification, and therefore it is unfair to consider restricted advice as being “poor” advice; however, the constraints under which a restricted adviser needs to work could result in a compromised solution.

Investment selection

One of the key differences between restricted and independent advisers is the range of investment options offered. Restricted advisers generally build their investment proposition from a limited range of “in house” funds. Whilst many of the major restricted advice firms use external managers to manage their investment solutions, the adviser will only be able to choose investments from the pre-selected available panel of funds. This could mean that the investment portfolio designed for the client doesn’t necessarily fit their needs and objectives.

Even more restrictive are the increasingly common mixed asset solutions that many restricted advisers are now regularly recommending. These ready-made portfolios are largely passive in nature, and with limited active fund management, the potential for outperformance is reduced. These mixed asset solutions are undoubtedly more efficient and cost-effective for the restricted advice firm but offer a wholly inflexible and “one size fits all” solution.

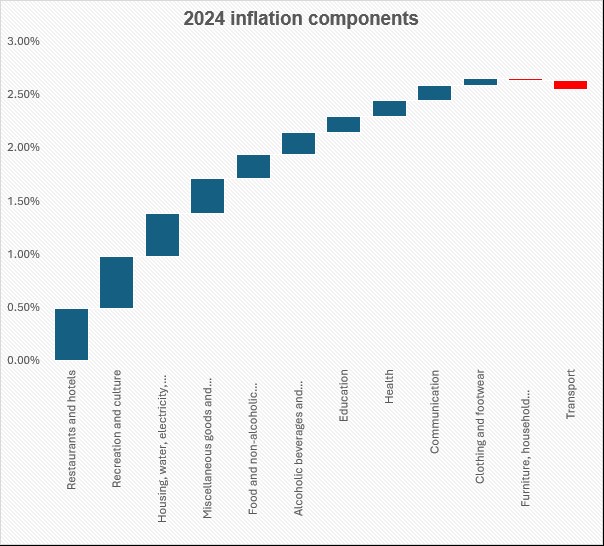

In contrast, an independent adviser can select funds without restriction, which can lead to improved performance over the long term. Our analysis shows that a range of popular mixed asset funds (shown in shades of red and orange on the following chart) have largely tracked each other over the long term. The performance of the CDI Progressive Growth portfolio, which is built from our independent investment process and invests in a similar asset blend to the sample group, is shown in blue.

Performance of a range of restricted multi-asset funds (red/orange) compared to performance of CDI Progressive Growth portfolio (blue), over the last 7 years

Source: FE Analytics February 2025

Whole of Market advice

There is a wide range of financial products available on the open market, and new solutions are regularly released by product providers, which are often designed to improve tax-efficiency in response to changes in legislation. Using an independent adviser will mean that an adviser is free from constraint and can select from these products if they fit a client’s needs and objectives; however, a restricted adviser may not even be aware that such products and solutions exist, or if they are aware, they may be unable to recommend the product if it is not within the panel of options permitted through the restricted advice process.

Good examples of the drawbacks of restricted advice can be found when considering Inheritance Tax (IHT) planning, which is clearly an area of concern for many clients. A range of providers have released products designed to mitigate IHT liabilities, including those that seek to qualify for Business Relief. Most stocks listed on the Alternative Investment Market (AIM) will qualify for business relief, and many Discretionary Managed IHT solutions focus on AIM stocks as a way of mitigating an IHT liability. The recent Budget announced that AIM investments will only qualify for half of the available Business Relief from April 2026 and qualifying AIM investments will therefore face a potential IHT tax charge of 20%.

Being able to look across the whole of the market means that an independent adviser can consider asset-backed Business Relief solutions. These investments differ from AIM stocks, as the investment is made in unquoted companies that carry on trades such as renewable energy, storage and logistics, or secure lending. Asset-backed Business Relief investments are designed to produce more predictable returns, without the associated volatility inherent in AIM stocks; however, the returns generated by asset-backed investments may be lower than AIM stocks in strong market conditions. Perhaps the most important difference is that qualifying asset-backed investments will continue to receive 100% IHT relief (i.e. the full 40%) on investments after 6th April 2026, subject to an overall cap of £1m held in Business Relief assets.

Business Relief solutions are only one of a range of different products designed to mitigate a potential IHT liability. There are a variety of different insurance solutions available across the marketplace, which involve the use of protection policies and are often written in trust. A restricted advice proposition may not have the scope to consider all these options.

Making the most of our independent status

We are proud of the independent holistic advice service that we provide to our clients, and our advice process takes full advantage of our independent status, aiming to tailor the most appropriate solution to each and every client circumstance.

Understanding the marketplace is an ongoing process, as new products are released, and existing products are adjusted regularly. Our Investment Committee undertakes regular reviews of available platform services, and we use independent and external research to provide us with an unbiased view of the costs and features offered by each platform. The Committee also uses expert external research and analysis to review Inheritance Tax solutions, Venture Capital Trusts, Enterprise Investment Schemes and many other products.

If you are using a restricted adviser, it may be wise to consider what your restricted adviser isn’t telling you. You may be missing out on potential solutions that could be a better fit for your needs and objectives, which could also mean lower charges and potentially improve investment performance and/or tax-efficiency. Speak to one of our independent advisers to discuss your existing arrangements. We would be pleased to undertake an unbiased and impartial review and explain where improvements could be made.