We are regularly asked to provide advice to parents and grandparents who wish to invest for their child or grandchild’s future, potentially to help with higher education costs, or towards a deposit for their first home, the cost of which has increased significantly over recent years. Data from Statista shows that the average deposit for first-time buyers in England in the 2022/23 tax year was £53,414. This is more than double the average deposit a first-time buyer needed to find in 2017/18, according to Savills. Even more stark is comparing the data to 1997/98, when the average first-time buyer deposit stood at just £2,200.

With the pressures of modern living, many young people will struggle to save for the average deposit, amidst costs of rent, household bills and living expenses. It is, therefore, often the case that children turn to the “Bank of Mum and Dad” for help, which could well coincide with a time when parents are aiming to clear mortgages of their own or trying to focus on their retirement planning.

Arranging appropriate investments for children can ease the financial burden for families and help provide the necessary funds to help pay for further education, or a house deposit. There are, however, decisions that need to be reached in respect of the structure of the investment plan, and whether to grant the child access to the funds at 18.

Tax-efficiency, but drawbacks

Two of the most popular methods of arranging children’s investments are structured so that the funds automatically belong to the child on their 18th birthday, which may not be a sensible step.

A Junior Individual Savings Account (JISA) allows a maximum investment of £9,000 per annum, and this can be funded by parents or other relatives, which can help with Inheritance Tax (IHT) planning. The JISA benefits from tax free returns and automatically converts to an adult ISA at 18.

A bare trust is another tax efficient way to save for a child’s future. The funds in trust belong to the child but are managed by the trustees (usually parents and grandparents) until they reach the age of 18. All income and gains generated within the trust are assessed on the child, except when the trust is created by a parent. In this case, income that exceeds £100 per tax year is assessed on the parent. It is important to note that this rule does not apply to grandparents.

Maintaining control

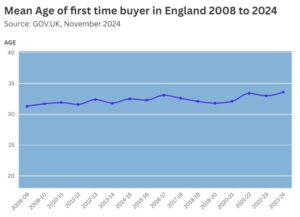

A common conversation point with clients are the risks involved when giving control of an investment to a child at the age of 18. Many parents and grandparents have concerns that the child may not make financially responsible decisions at this point in their life. As we mentioned above, the most common uses of investments for children are funding university costs or using the funds towards a deposit on a house; however, funds are unlikely to be needed for either purpose at the age of 18. Student loans cover the cost of tuition fees, and maintenance loans may cover some of the costs of living. The average age of a first-time buyer is 33 years old, and realistically, it is unlikely that anyone turning 18 will have sufficient earnings to support mortgage payments.

The risk is, therefore, that the child could use the funds for other purposes, such as holidays or socialising, and given the lack of control, could lead to disappointment that funds have been used unwisely, or could generate unwanted family friction.

The alternative is to exert control over when the child gains access to the funds. This is often a more palatable option; however, there are drawbacks that need to be considered. Instead of a bare trust structure, where the child owns the investment from the age of 18, a discretionary trust offers far greater flexibility and control. The trustees have complete discretion as to when funds are paid, and to which beneficiary. This is an ideal way of avoiding automatic access at 18, whilst still gifting funds, so that they leave the parent or grandparent’s potential estate. Discretionary trusts do, however, suffer a more punitive tax regime, which starts with the gift into trust and covers both income tax and capital gains tax. Additionally, discretionary trusts also suffer a potential charge to IHT at each ten-year anniversary.

Despite these drawbacks, careful planning can help reduce the tax burden significantly, and investment structures such as investment bonds can also avoid the need for trustees to account to H M Revenue & Customs each year. Segments of the Bond can be assigned to beneficiaries at a time trustees agree is appropriate, which could ease the tax burden further.

An alternative option is for parents and grandparents to set up separate investment accounts for their children, which remain held in the name of the parent or grandparents. Often such accounts carry a designation, to ensure that the investments remain separate to other accounts held. Naturally, such an approach would not be effective for IHT purposes as the investment remains in the name of the parent or grandparent, and the owner remains liable for income tax and capital gains tax; however, with careful selection of tax wrapper, a more tax-efficient approach can be adopted.

Getting the right advice

Parents and grandparents who wish to save for the next generations can explore a range of options, each with positives and drawbacks. Perhaps the best starting point to consider is whether you are content to give automatic access to the funds at 18 years old. In many cases, maintaining greater control is attractive, and with careful planning, the more onerous tax burden can be effectively managed. Our independent advisers have years of experience of advising parents and grandparents in this area. Speak to one of the team to start a conversation.