You may well have noticed the intense media coverage of the rise in UK Government bond yields since the start of the year, which have led to Chancellor of the Exchequer Rachel Reeves coming under increased pressure. Bond markets saw weakness through the final quarter of 2024, which intensified over the first few trading days of this year, over concerns that the Government will need to borrow more money to fund their spending plans. This is not the first time, nor will it be the last, that bond market conditions move from being an investment story to headline news. Just over two years ago, bond market turmoil led to the resignation of Liz Truss in the wake of the infamous Kwasi Kwarteng budget, and in 1976, Harold Wilson’s Government was forced to borrow money from the International Monetary Fund due to the spiralling cost of debt.

How is it that bond markets can exert so much influence? The reason is that Government bond yields are a critical indicator, and have implications for the outlook for risk assets, the wider economy and personal finance.

Bond yields in focus

When Governments look to borrow money, they often do so by issuing bonds, which are known in the UK as gilts. Each gilt offers a fixed rate of interest for the life of the issue and have a redemption date, at which point the Government will buy back the gilt for a fixed price.

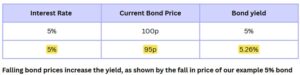

Take the example of a gilt issued today, with a redemption date in 10 years’ time. The gilt carries an interest rate of 5% per annum. At the point of issue, the gilt is priced at 100p and it will be repurchased in 10 years at 100p. At launch, the yield on the gilt (which is calculated by dividing the interest by the bond price) is 5%. The Government therefore knows the amount of interest payable on the debt, and investors can easily determine their rate of return if they hold the bond to redemption.

Gilts and other bonds are, however, traded securities, and bond prices will fluctuate over time, with factors such as the underlying base interest rate, the economic outlook and global conditions influencing the direction of bond prices. Low confidence in the economic outlook can lead to investors selling gilts, leading to a fall in price. Any such fall in price increases the yield. Using the example above, if the gilt price fell from 100p to 95p, the yield on the bond would increase from 5% to 5.26%.

Such a move would not impact the level of interest paid by the Government on this particular bond; however, the yield sets the market expectation at which future bonds would need to be priced. Gilts regularly redeem and indeed, gilt issuance is likely to rise to help finance the Government’s spending plans. As a result, the interest costs paid on Government borrowing would rise over time, as new issues need to offer a higher rate of interest to match market expectations.

Bond yields have wider implications

When investing in fixed interest securities, such as gilts and other bonds, the yield is clearly critically important, as it represents the return that you can achieve from holding the bond to maturity. Gilt and other major Government bond yields also set a benchmark return that you could achieve without taking significant investment risk. This has a direct impact on other investment markets, such as equities, as a higher yield makes bonds more attractive to investors relative to equities, and can lead to investors moving out of riskier assets and buying bonds instead.

Central banks also keep a close eye on Government bond yields, as the yield on key benchmark loan durations provides a temperature check on the health of the economy. Sharp increases in bond yields, as experienced in the UK and US recently, could lead to central banks raising overnight interest rates.

Pressure in bond markets not only affects investors but also impacts on other areas of personal finance. Pension annuity rates are calculated with reference to gilt yields, and rising yields can have a positive impact on annuity rates. The opposite is, of course, true, as witnessed by the very poor annuity rates offered when interest rates stood at close to zero during the Covid period.

The rates offered on fixed-rate mortgages are also sensitive to movements in gilt yields, as interest rate expectations are used to calculate rates offered by mortgage lenders. Many individuals will see cheap fixed-rate deals taken out over the last five years coming to an end in 2025, and a spike in yields could heap further pressure on borrowers whose current deal is ending. In turn, this could impact mortgage affordability and dampen demand in the housing market.

Any further constraint on the public purse can also have a knock-on effect on personal finances. If Government borrowing costs become more expensive, this may lead to cuts to expenditure on public services or could force the Government to raise taxes further.

Where next for bond yields?

The increase in yields seen over the last few months is largely a reflection of changes in interest rate expectations. Inflation has been nudging higher, moving further away from the Bank of England target rate of 2%. Investors are also nervous about the prospect of trade tariffs being imposed by the incoming Trump administration.

Given these factors, bond markets are likely to remain volatile in the short term. Whilst the spotlight has rightly been placed on the pressures on UK gilts, bond yields have also risen in the US and Europe, which lead to investment opportunities within fixed income investments. This may well be an ideal time to consider the allocations you hold in fixed income within your investment portfolio. Speak to one of our experienced team if you would like to discuss how your investments are positioned.