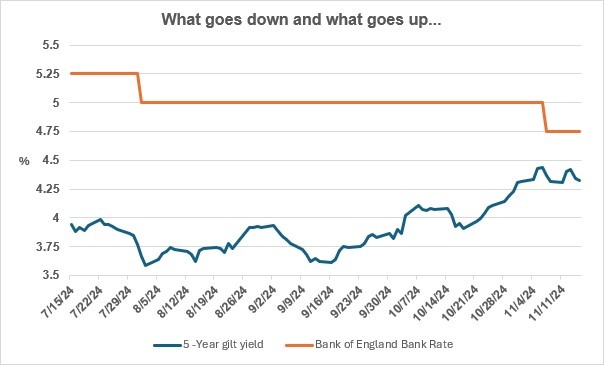

Source: Bank of England, Investing.com

Not every interest rate moves in the same direction.

If you are approaching the end of your five-year fixed rate mortgage and currently enjoying an interest rate of around 2%, you have probably been watching the fluctuations of interest rates with some trepidation. The November 0.25% cut from the Bank of England has not fed through to your prospective remortgage interest rate and some lenders are even going in the opposite direction of the Bank and nudging rates upwards. What’s going on?

The answer is nothing unusual, despite the contrary movements. It is a common misconception that the Bank of England controls interest rates. The Bank does manage short-term interest rates by setting its Bank Rate, which is the rate it pays on the money it holds for commercial banks. By fixing a minimum fully secure return that the commercial banks can earn, the Bank of England influences what those banks can charge for lending. The key point is that the Bank of England is setting a short-term rate which can, in theory, change every six weeks, when the Bank’s Monetary Policy Committee meets to set rates.

Longer term interest rates are not usually controlled by the Bank of England but set by the markets. Those markets will take account of the current Bank Rate, but if a fixed rate for, say, five years is under consideration, then the market is implicitly estimating the path of Bank Rate over the next 60 months. That forward-looking calculation has a wide range of factors built into it, like any medium-term financial forecast. The result can be that as the short-term Bank Rate is cut in response to current economic conditions, longer term rates rise because of the markets’ views of longer-term prospects. The graph above illustrates how the Bank Rate and the yield on five-year fixed rate government bonds have moved between mid-July and mid-November in 2024. While the Bank Rate has fallen 0.5% over the period, the yield on the five-year gilt has risen by about 0.4%. That reflects the market changing its mind about how quickly and far the Bank will cut rates.

If your mortgage is due for refinancing soon, you may find yourself hopefully watching the markets for signs of that change of mind.

Your home is at risk if you do not keep up with repayments on a mortgage or other loan secured on your property.