Most investors instinctively feel comfortable investing in their domestic stock market. The FTSE100 index of leading UK shares is made up of familiar names, and within the largest quoted companies, investors can gain access to attractive dividend yields and modest valuations. The reality is, however, that investors in UK equities will have seen returns lag behind those achieved by their global counterparts over the medium term.

Diminishing influence

The story for 2024 has been all too familiar for UK equities. In the period from 1st January to 30th October – the day of the Budget speech – the FTSE100 index of UK shares produced a total return of 8.92%, compared to the S&P500 index of US shares, which returned 20.37% over the same period. The gap between the UK and US indices has widened further during November, as investors digested the impact of the Budget on the outlook for UK equities, and US shares enjoyed a boost from the clear Trump victory. Further evidence of a lack of investor confidence in the UK can be observed given the large outflows seen from UK equities in advance of the Budget.

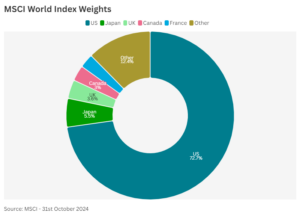

The London Stock Exchange is one of the oldest known trading exchanges; however, the influence the UK can exert in a rapidly changing world is diminishing. Within the MSCI World Index, a composite index of the largest global companies, the UK now accounts for just 3.5% of the index weight, compared to 72% for the US.

The explosive growth in the largest US quoted companies has seen the market capitalisation of Apple, Nvidia and Microsoft all individually exceed the combined value of the largest 100 quoted companies in the UK.

One of the reasons for the lack of traction within UK equities is the absence of large-cap technology stocks. The market clamour for stocks involved in artificial intelligence and other high-growth areas has seen value equities, which offer solid cash flow and attractive dividend yields, fall out of favour. Indeed, the decision of British chip designer ARM Holdings, which decided to relist in New York rather than London, was further evidence that technology stocks that wish to gain wider investment exposure can do this more readily on the Nasdaq exchange.

Impact of the Budget on confidence

You could reasonably argue that the recent Budget has done little to boost the fortunes of domestic equities. Prior to the Budget speech, confidence in the prospects for the UK economy was already at a low point. Government ministers repeatedly warned of tough measures in the Finance Act and the Budget speech itself surprised many economists and commentators with the breadth of tax raised.

From a business perspective, additional costs from the hike in Employer’s National Insurance are likely to impact UK growth. Firms could look to trim expansion opportunities, or more likely pass the additional costs onto the consumer. Sectors such as leisure, hospitality and retail, where many workers receive the minimum wage, will see a direct increase in wage costs from April 2025, which will squeeze margins further.

This set of events have the potential to nudge inflation higher during 2025, and potentially force the Bank of England to re-shape the trajectory for UK interest rates. Whilst further rate cuts are expected, there is growing consensus that the pace and timing of the cuts may be slower than anticipated.

Consumer confidence remains weak, with the “cost of living” crisis still alive and kicking. The combination of mortgage rate resets for those coming off cheap fixed rate deals, higher energy costs and static tax bands, mean that consumers may shun big ticket items whilst focusing on essentials.

An improving outlook for the UK economy could increase investor appetite and boost the prospects for UK equities; however, the projected growth figures announced in the Budget suggest that GDP growth will remain subdued over the next five years. As a result, investors, who take a global approach to investment, may well look to other markets, where growth potential is more appealing.

Reasons to be cheerful

Given the current position, we have painted a rather negative picture of the prospects for both the UK economy and UK equities over the medium term. There are, however, reasons to invest in UK equities, particularly if the investor seeks a high level of dividend income. The current dividend yield on the FTSE100 is 3.70%, although companies offering yields well in excess of this level can be found. Seeking income from overseas investments can be more difficult, with the S&P500 index of US shares producing a dividend yield of just 1.19%.

UK equities are undoubtedly cheap when using certain metrics, with the FTSE100 standing at a considerable discount to the implied earnings growth of the S&P500 index. The UK also stands at a slight discount to Eurozone equities. Whilst you could argue that this suggests that the UK is attractively priced, it is entirely possible that the relative value on offer is by virtue of the modest outlook for growth. In other words, the UK could be “cheap for a reason”.

The UK still has a place

Despite the weaker outlook, it would be unwise to dismiss UK equities. We believe they command a place in a well-diversified investment portfolio, particularly for investors who are seeking income from equities, or value to counterbalance growth in a diversified approach. It would, however, be sensible to consider the composition of your investment portfolio, as holding excessive weights in the UK, without adequate global diversification, could limit the prospects for investment returns, and also introduce additional risk. Many traditional discretionary management services focus on UK equities, and we have seen examples where performance has lagged due to an overallocation to domestic positions.

Our experienced advisers can help review existing investment portfolios and provide independent advice on the current asset allocation, diversification and levels of risk. Speak to one of our advisers to discuss your portfolio in more detail.