After a bumpy ride through the post-Covid World, investors may well look back at 2024 with a sense of relief. This year has seen the return of positive market conditions, where investors have been rewarded for taking investment risk, and market sentiment has proved strong enough to shrug off any immediate geopolitical concerns.

A good year for investors

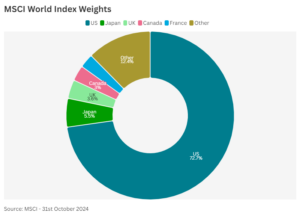

Barring any major jolt before the end of the year, investors can reflect on a positive year, with equities, bonds and alternatives all seeing gains. Relative performance across asset classes has, however, seen a handful of major markets underperform, and adopting a global investment view, with a heavy exposure to the US, has been the key to success over the last 12 months.

With inflation returning to more modest levels, the prospect of lower interest rates, coupled with investor appetite for stocks involved in Artificial Intelligence propelled markets during the first half of the year. The positive momentum has continued, with a further spurt of outperformance seen from US indices after the US election result. Away from the US, the Nikkei 225 index in Japan broke through the psychologically important 40,000 level for the first time in March, after regaining levels not seen since 1989. It has recently regained this level once again, despite a sharp fall and recovery in August amidst a spike in the value of the Yen. Looking closer to home, UK equities made modest returns, lagging those seen in the North America and Asia Pacific regions.

Political upheaval

2024 was always going to see politics take centre stage, given the number of countries holding major elections. It has proven to be a year of political change, with elections in the UK and US seeing incumbent parties voted out of office. With many predicting a US election that was too close to call, markets breathed a sigh of relief that a clear winner emerged. President elect Trump’s emphatic victory will herald both opportunities for further growth under a pro-business leader, and greater uncertainty over foreign policy decisions that will affect global stability. The clean sweep victory for the Republican party should provide a strong platform for Trump to push through his chosen policies.

Following a landslide victory in the General Election, the new Labour Government has endured a tumultuous honeymoon period. Throughout August and September, the new administration effectively talked down the prospects for the UK economy and warned that a tax raising Budget would be forthcoming, which was duly delivered on the eve of Hallo’ween.

France has endured months of political turmoil, and recently led to the fall of Michel Barnier as Prime Minister, and events in South Korea briefly spooked markets earlier this month, as the sitting President tried to impose martial law.

Whilst 2025 may not be impacted by global elections, unresolved issues remain, and politics will continue to influence global markets. We expect Eurozone defence spending to be a prominent talking point, in particular given the hawkish words from incoming President Trump about NATO spending. US-China relations could sour if Trump imposes tariffs and rhetoric over Taiwan intensifies.

Higher tax take and a weakening economy

Rachel Reeves’ first Budget brought about a series of significant changes to the way assets and wealth are taxed. The far-reaching set of measures, which may be the most impactful for many years, have received a very mixed response, leaving businesses and the farming community deeply unimpressed.

Apart from the increase in Capital Gains Tax rates, which applied immediately after the budget, many of the changes will come into force in the next and future tax years. Pensions will be brought into the scope of Inheritance Tax from April 2027, which may well mean those in retirement with unused pension funds need to reconsider their plans. The changes to Agricultural and Business relief, which have been met with anger and resentment from the farming community and business owners, will come into force a year earlier, in April 2026. From a planning perspective, those with substantial pension or business assets should look to reassess their financial plans, and holders of agricultural property should begin to gather valuations of assets to see what action can be taken to reduce any likely Inheritance Tax charge.

The planned increase to Employer National Insurance from April 2025 is already being felt in the jobs market, and domestic consumer and business confidence remains at a low ebb. It is, therefore, of little surprise that the initial reading for October saw the UK economy shrink for a second consecutive month.

UK consumers remain under pressure from modest wage inflation and spiralling prices. Many homeowners will see existing fixed rate mortgage deals end in 2025, which will add further affordability pressures, and the end of the Stamp Duty relief for first time buyers in March could limit any further growth in the UK housing market.

We have often commented about our concerns for the health of the UK economy. Early indications are that the impact of the Budget will exert further pressure on an economy that has limped along for some time. The Bank of England would ordinarily look to give the economy a boost by cutting interest rates more aggressively; however, the likelihood of higher inflation in the first half of next year could see the pace of cuts slow as we head through 2025.

Festive wishes

As we draw a close on 2024, we look forward to a year that still presents opportunities for nimble investors. Our first Wealth Matters of 2025 will set out our predictions for the year ahead; however, at this point we take this opportunity of wishing our readers a very Happy Christmas and a healthy and prosperous 2025.