Whilst not delivering some of the more outlandish predictions that had been suggested in the media over recent weeks, the measures announced in the Budget statement certainly provide opportunities for effective financial planning in a number of areas. We will delve more deeply into these planning opportunities in future issues of Wealth Matters; however, for now, we provide our summary of the key measures announced.

Employer’s National Insurance

The rate of National Insurance (NI) paid by employers will increase from 13.8% to 15% from 6th April 2025. In addition, the salary threshold at which employers begin to pay NI has been reduced from £9,100 a year to £5,000 a year. Small businesses will see an extension to the employment allowance. There have been no other changes to NI, with the main rate payable by employees remaining at 8% on earnings between £12,570 and £50,270.

The increased rate of employer NI from April 2025 is likely to enhance the attractiveness of salary sacrifice arrangements, and the ability for company directors to make employer contributions into a personal pension.

Capital Gains Tax

The rates of Capital Gains Tax (CGT) applicable to the sale of non-residential property assets will increase from 10% (for basic rate taxpayers) to 18% and from 20% (for higher and additional rate taxpayers) to 24%, with the changes effective immediately. The new rates for gains on share disposals match the rates that currently apply to residential property gains, which remain unchanged. The hike in CGT rates is lower than many people had anticipated, which reinforces the need to carefully consider whether to dispose of assets that may give rise to a CGT liability.

Business Asset Disposal Relief

Business Asset Disposal Relief (BADR) will gradually become less attractive over the course of the parliament. Currently business owners who sell all or part of their business can benefit from a rate of 10% on all gains up to a lifetime limit of £1m. The rate will increase from 10% to 14% from 6th April 2025, and again to 18% from 6th April 2026, aligning this rate with the rate of Capital Gains Tax payable by basic rate taxpayers.

Inheritance Tax

The Government has announced the intention to bring pensions into the Inheritance Tax (IHT) regime from 2027. The Budget statement is light on detail, and clearly further clarification is needed, particularly in respect of the tax treatment that applies when beneficiaries draw from an inherited pension. The impact of the new rules will no doubt become apparent during the consultation process.

In addition to the proposed changes to pension death benefits, the Chancellor announced a new combined limit of £1m for assets that qualify for Agricultural Relief and Business Property Relief. Expected to come into force in April 2026, qualifying assets under £1m will continue to benefit from 100% relief from IHT; however qualifying assets above this level will only benefit from 50% relief, leaving such assets subject to an effective rate of IHT of 20%. This is a punitive move for those holding agricultural assets or family businesses.

The IHT rate payable on qualifying shares quoted on the Alternative Investment Market (AIM) will be set at an effective IHT rate of 20%. Previously, qualifying assets listed on AIM have been covered by the Business Relief exemption.

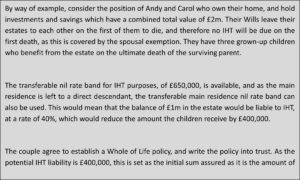

All other IHT bands remain unchanged, although the freeze on thresholds has been extended until 2030. The main nil-rate band will continue at £325,000 with the additional £175,000 being available in respect of a residence bequeathed to a direct lineal descendent. These allowances remain transferable between spouses, so that the surviving spouse can continue to pass up to £1m without an IHT liability. With increasing asset prices, the number of estates liable to IHT is set to increase over the course of the parliament.

Pensions

Apart from the proposals to bring pensions under the IHT regime from 2027, there were no other major changes to pension rules announced in the Budget. Existing rules on tax relief remain unaltered, as does the current maximum level of Tax-Free Cash available (£268,275). Additionally, there have been no changes to the pension annual allowance.

Personal Tax Thresholds

Whilst Personal Tax thresholds will remain frozen until 2028, the Chancellor confirmed that the Personal Allowance for Income Tax will increase in line with inflation from the 2028/29 Tax Year and beyond.

Stamp Duty Land Tax

The rate of Stamp Duty charged on second or additional properties will increase from 3% to 5% with effect from Thursday 31st October. The Budget Statement also appears to rule out any extension to the temporary Stamp Duty discount for first-time buyers which is due to end in March 2025.

Individual Savings Accounts

The annual subscription limits for Individual Savings Accounts (ISAs) will remain frozen at £20,000 until April 2030. The limits for Lifetime ISA and Junior ISA will also remain frozen at £4,000 and £9,000 per tax year, respectively. The British ISA, a policy idea announced by the previous Government, has been scrapped.

Summary

Taken in the round, the measures announced are not as painful as many had been predicting in the weeks leading up to the Budget statement. Our initial assessment of the Budget statement does present interesting planning opportunities, which we will cover in more detail in future editions of Wealth Matters. Contact our experienced advisers if you would like to discuss the impact of the Budget on your financial plans.