US sets the tone

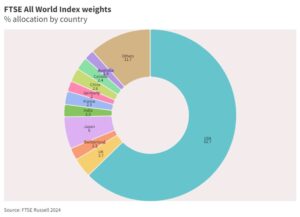

The US election result will have fundamental implications for the outlook for global investments. US stock markets are by far the most influential global indices, with US quoted companies accounting for 62% of the FTSE All-World index, with Europe lagging way behind on 15% and Asia Pacific accounting for just 10% by weight. The performance of the S&P500 and Nasdaq sets the tone for the performance of European, Asia Pacific and Emerging Markets. As such, UK investors need to pay careful attention to the outcome of the US election. If US markets react positively to the result, this may well boost investor confidence globally.

Democrats and Republicans take a very differing stance on a range of issues, some of which are domestically focused and will affect US consumers and businesses directly. There are, however, a range of issues that are relevant to global stability and may have far reaching implications.

Foreign policy

Harris and Trump are likely to follow a very different path when it comes to foreign policy, which may have wider implications for global security and could have economic consequences, too. Trump has repeatedly stated that other NATO countries need to increase their spending and has indeed threatened to pull the US out of NATO. This is in stark contrast to the position that Harris is likely to adopt, which will be a continuation of the existing policies currently in place. With the Russian invasion of Ukraine contributing to the rapid increase in the cost of commodity prices in 2022, any significant escalation of tension between the West and Russia, could drive up commodity prices once again, and threaten stability.

The conflict between Russia and Ukraine is one of three potential threats to global security that the next President will need to deal with. Tensions in the Middle East could morph into a wider conflict in the region, and the strained, but relatively stable, relationship between the US and China may well be managed differently should Trump become President once again.

Climate policy

The Biden administration has wholeheartedly supported the transition to clean energy as part of the Inflation Reduction Act, which provides tax credits for electric vehicles. Harris is likely to continue the same path and has indicated her firm support for increased spending to tackle climate change. On the other hand, Trump is likely to take a different stance, given his record on carbon emissions and fossil fuels. The outcome of the election may well impact the fortunes of oil and gas companies, who could be beneficiaries of a Trump victory.

Tariffs

Both Democrats and Republicans may seek further tariffs on imported goods, although Trump is likely to go further in imposing higher tariffs on goods from China. This may prove to be inflationary, as US consumers face higher costs for imported goods. The Federal Reserve’s actions since 2022 to combat inflation have been largely successful, and a resurgence of inflation could prove negative to both equities and bond markets. One potential positive from the imposition of tariffs may be an increased drive towards domestic production, which could benefit the US manufacturing sector.

Tax and spending

A Trump victory could provide a boost to US consumer spending, as he is likely to be in favour of additional tax cuts, which would leave US citizens with more money in their pockets each month. Cuts to business tax could also prove positive for US corporate profitability. The Democrats have called for the removal of tax breaks for higher earners, and an increase in corporate taxes from 21% to 28%. Trump is likely to promote the reduction of red-tape and regulation on business, whilst Harris is likely to favour big state and increased regulation.

Monetary policy

US national debt continues to climb exponentially, standing at US$35tn. When Trump became President in 2016, US national debt stood at US$19.95tn, although a good proportion of the increase in debt since 2020 can be attributed to the Covid pandemic. The cost of servicing the debt has increased significantly over the last two years and tackling the ballooning debt is not a job either Harris or Trump will relish. Reversing the annual deficit, so that debt does not rise further, is a significant challenge and would involve cutting public spending, raising tax significantly, or both.

Should Trump get the keys to the White House for a second term, there could even be a change to the way that monetary policy decisions are reached. Trump has indicated that he would prefer to see the President have a say when the independent Federal Reserve makes decisions on US interest rates. This would mark a fundamental change to the current process and remove the independence that the Federal Reserve enjoys.

No honeymoon

Whoever wins the election in November may not have everything their own way. It is a possibility that the eventual victor may see the opposing party controlling either the House of Representatives, or the Senate. This would mean policy decisions would not necessarily pass and could weaken the ability for the President to successfully implement their election promises.

Outlook for US equities

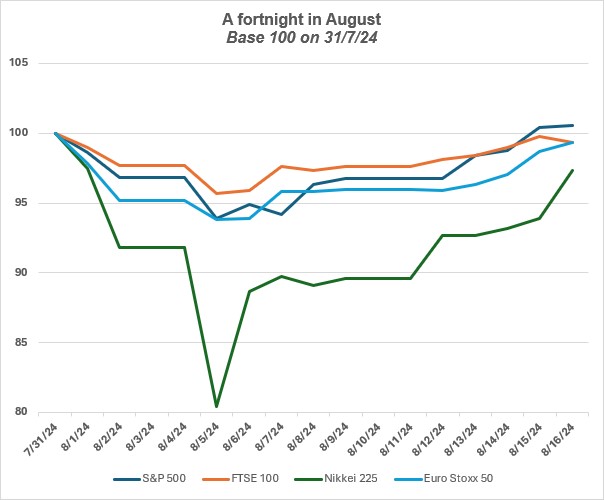

US equities have been the catalyst for the strong global equity market performance since last November, and this trend shows no signs of reversing. Continued economic growth, the expectation of supportive monetary policy and strong corporate earnings are factors that support our conviction to US equities. Apart from a short-lived spike last month, volatility has remained low through the year to date; however, the upcoming election could see volatility increase as the US heads towards the polls.

Our experienced financial planners are on hand to discuss the exposure to US equities within your portfolio. Speak to one of the team, who would be pleased to review your existing portfolio asset allocation.