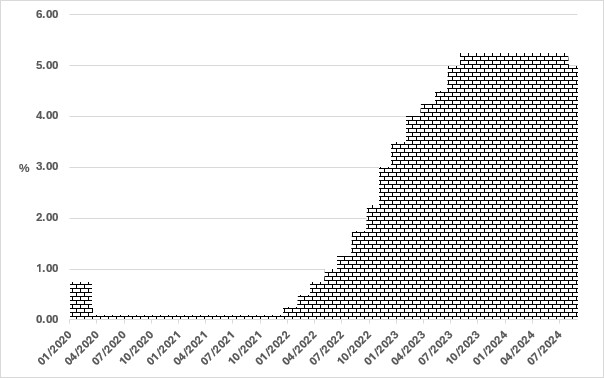

Source: Bank of England

As the Bank of England cuts interest rates for the first time in over four years, what are the implications for your investments?

The Bank of England did something unseen since 19 March 2020 this summer: it cut the Bank rate. The decision was a close call for the Bank’s Monetary Policy Committee (MPC): five voted for the reduction while four favoured holding rates unchanged. However, that 5–4 margin reflected more a question of timing than direction.

After nearly a year with the Bank rate stuck at 5.25%, investors are now pondering two new questions: how fast will rates fall and how far? Unlike its counterpart in the United States, the Bank of England does not offer its own opinions on future rates. Instead, the Bank prefers to produce its economic outlook using the future interest rates implied by the UK money markets. These currently suggest that the Bank rate will be 4.2% in the third quarter of 2025, 3.8% a year later and 3.5% by the third quarter of 2027. Such numbers come with a health warning: unanticipated events can wreck the most carefully calibrated forecasts – as recent years have demonstrated.

Nevertheless, assuming no global pandemics, further wars or other international incidents, UK interest rates look set on a downward path, although a return to the near-zero rates of the 2010s is not on the radar according to those money market projections. Those rates were a prolonged response to the 2008 global financial crisis (followed by Covid-19) and are already beginning to appear an historic aberration.

Impact of falling rates

The expected steady decline in interest rates has several consequences for investors, including:

- New investors will see the return on fixed interest securities such as government bonds fall. This move is already underway, as investors buy to lock in current returns. For example, the benchmark 10-year government bond was yielding over 4.6% in October 2023, whereas by mid-August 2024 its yield was under 4%.

- Falling long-term bond yields go alongside a drop in annuity rates. If you are thinking about fixing all or part of your retirement income, delay could prove costly.

- Returns on cash deposits will drop as the Bank rate falls. So far in 2024 it has been easy to find cash returns above the rate of inflation, discouraging investors from leaving the investment sidelines. Inertia is a now a serious risk if you are sitting with cash. Wait too long before making your move into long-term assets and you could miss investment profits.

- Lower interest rates benefit companies, particularly smaller companies which tend to have higher borrowing. In the US, which is at a similar stage in the interest rate cycle, there have been signs that investors are switching their attention from the mega companies towards smaller companies.

For advice on how you should approach an investment landscape of falling interest rates, talk to us soon – the longer you defer, the lower rates could drop.

Investments do not offer the same level of capital security as deposit accounts.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.