The Labour Party’s 2024 manifesto said, ‘We will not increase National Insurance, the basic, higher, or additional rates of Income Tax, or VAT.’ The absence of any comment on CGT meant that Rachel Reeves received persistent questions during the election campaign about a possible increase. Unsurprisingly, there was no definitive answer.

Will increased capital gains tax (CGT) mean less tax gets paid?

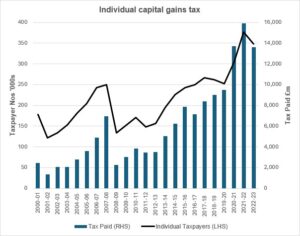

Source HMRC

At the beginning of August, HMRC published new data about how much CGT had raised. The figures were for 2022/23, when the annual exemption was £12,300 of gains, as opposed to the current £3,000. Nevertheless, they provide some interesting information about who pays how much:

- Only 348,000 people made enough capital gains to pay the tax. That is about 1% of the number of income taxpayers.

- The total amount of CGT paid by individuals was £13.63 billion, with trusts accounting for another £0.797 billion.

- 2,000 taxpayers – less than 1% of all CGT payers (who realised at least £5 million of gains) – paid 41% of all CGT collected from individuals. Another 4,000 taxpayers with gains between £2 million and £5 million paid 16% of the total.

- There was more tax paid in the previous two tax years. Between 2021/22 and 2022/23 the Exchequer’s receipts fell by 15%.

That final bullet point deserves an explanation, because it is unusual for tax receipts to fall year-on-year, yet alone for two years. In July 2020, the then chancellor Rishi Sunak, commissioned the now-defunct Office of Tax Simplification (OTS) to review CGT. The move prompted speculation that CGT would be increased, a sentiment that was reinforced when the OTS suggested aligning CGT rates with income tax and sharply reducing the annual exemption. The predictable result was a pre-emptive rush to realise gains, boosting CGT payments.

In the event, Mr Sunak ignored the OTS proposals, although subsequently one of his many successors did take up the idea of cutting the annual exemption. As we wait to see what will be in Rachel Reeves’ Budget on 30 October, the story of CGT receipts may have provided her with an interesting lesson: hints of raising the tax are enough in itself to generate extra revenue.

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice.