Commercial property has traditionally played an important role in portfolio diversification. Direct Property funds that invest in UK physical property assets, such as warehouses, office and industrial space, has traditionally found a place in many portfolio strategies, as it tends to produce consistent returns, that show little in the way of correlation with other assets, such as Equities (shares).

Challenging markets

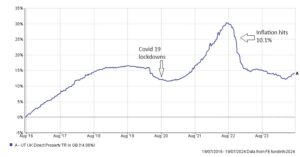

It is fair to say that the commercial property sector has faced a number of challenges over recent years. Many property holdings experienced void periods during the Covid-19 lockdowns, with the office and retail sectors particularly badly affected. In the aftermath of the lockdowns, commercial property has, again, struggled to spark interest from investors due to the spike in inflation which led to the rapid increase in interest rates during 2022 and 2023. The graph below shows the performance of the Investment Association UK Direct Property sector over the last eight years. Consistent returns were enjoyed until the Covid-19 outbreak, and following a rapid recovery as the economy reopened, the sector has faced serious headwinds as inflation and interest rates climbed.

Improving outlook

There is, however, increasing evidence that the prospects for the commercial property sector are improving. The Bank of England appear ready to press ahead with the first of a number of base interest rate cuts in the coming months. This could well prove positive for commercial property assets, as the returns achieved from property investments are particularly sensitive to monetary policy decisions. As base rates fall, and inflation settles around the Bank of England’s target, the rental income received from commercial property becomes relatively more attractive.

Further evidence of the improvement in sentiment can be found in the Royal Institute of Chartered Surveyors (RICS) UK Commercial Property Monitor, published earlier this year. The RICS research indicated that demand for retail and office space – two of the sectors of the property market that have been hardest hit – had seen the first tentative signs of increased demand. Furthermore, there is growing confidence amongst those surveyed that rents will increase over coming months.

Liquidity issues

Aside from the pressures of lockdown and adverse monetary policy, collective funds investing in direct property have also had to face liquidity issues that first surfaced immediately after the Brexit decision to leave the EU in 2016, which led to increase demand from investors wishing to sell their investments. As direct property funds hold large bricks and mortar property investments, that cannot easily be realised, increased demand from investors at the time exhausted liquid funds, and as a result, leading commercial property funds managed by the likes of M&G, Janus Henderson and Legal & General closed their doors to withdrawals temporarily.

Most funds reopened after 2016, and could be traded without restrictions, until the Covid-19 pandemic caused a further round of suspensions and liquidity concerns. Several funds have limped on, but a number of leading players in the industry have taken the decision to wind-up their property funds. M&G announced the wind-up of their Property Portfolio last October, with the process ongoing. Janus Henderson sold their entire property portfolio to a single buyer in 2022 and repaid investors, and St James Place’s property fund remains gated since the decision was taken to suspend withdrawals in October 2023.

Evolving strategies

Despite the loss of a number of funds within the sector, investors can still select from a range of direct property funds; however, those that remain open typically hold a higher allocation to cash, to mitigate against liquidity concerns. One of the largest funds in the sector, Legal & General UK Property, has taken the decision to make more fundamental changes to their portfolio, and have asked shareholders’ permission to alter the asset allocation, in an attempt to provide adequate liquidity and avoid holding excessive levels of cash, which can dilute returns. The Legal & General fund will continue to hold direct property assets; however it will also aim to hold an equal allocation to Real Estate Investment Trusts (REITs). These are quoted companies that hold a portfolio of direct property, from retail parks to student accommodation. As the shares are quoted and actively traded on the London Stock Exchange, their inclusion should alleviate future concerns over liquidity.

Additional considerations

There are, however, significant differences between a REIT and a direct property unit trust, which investors need to consider carefully, as the introduction of REITs changes the risk profile of a commercial property fund.

Firstly, a REIT can borrow money to purchase securities. This leverage is not present with a direct property fund and does introduce additional risk. Secondly, the buying and selling price of a REIT may not reflect the value of the underlying property portfolio, and the shares can trade at a discount or premium to the underlying value of the portfolio. Currently, many REITs stand at a discount to their net assets, reflecting the difficult conditions seen over recent years; however, an improvement in the fortunes for the sector could see these discounts narrow.

Is a hybrid approach the answer?

We wait to see the response to the changes made to the Legal & General Property fund, and whether other property funds may consider similar changes to their portfolios. It is clear that the ongoing liquidity concerns have cast a shadow over the sector and any measures taken that remove barriers to investment should be seen as a positive step. Investors will, however, need to carefully consider the impact of any changes within the asset mix within property funds.

Diversification remains the key

Commercial Property investments have traditionally helped diversify investment portfolios, and the improving market outlook, together with changes being made within the sector to alleviate investor concerns, may see fund inflows improve. We always recommend that investors adopt a diversified approach to investment, and hold a precise mix of assets that match your objectives and tolerance to investment risk. This is where our experienced advisers can add significant value, by considering your exact circumstances to determine the correct asset allocation for your investment or pension portfolio. Speak to one of our independent advisers to start a conversation.