In a little over a month, the UK will head to the polls in a much-anticipated General Election. The announcement by Rishi Sunak to call a General Election for 4th July caught many observers off guard. Whilst not unprecedented, summer elections are rare, and many were expecting the Tory leader to call an election in the autumn or winter.

Thus far, market reaction has been muted, which is not surprising, given the relatively limited impact domestic politics can exert over global markets. It is important to recognise that global factors carry greater significance, with the Middle East, Ukraine and US economic policy decisions likely to provide greater direction than political decisions at home.

As both major parties begin to firm up their manifestos ahead of the election, one major theme adopted by both sides will be the importance of financial prudence. Whilst the economic outlook is improving, with UK GDP returning to growth in the first quarter of 2024 and inflation falling, the adverse market reaction to the mini-Budget in 2022, which caused Sterling to fall heavily and gilt yields to rise sharply, will be fresh in the minds of both parties when making spending pledges. Whether Jeremy Hunt remains as Chancellor of the Exchequer, or Rachel Reeves takes up the role, both are likely to tread carefully when announcing policy decisions over coming months.

Can history provide any clues?

To help understand how markets have reacted historically in the period immediately after UK General Elections, we have undertaken research looking back at the performance of the FTSE All-Share Index, which is the broadest measure of performance of UK quoted companies and captures 98% of the UK market capitalisation.

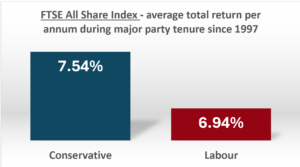

Our analysis shows that UK markets have historically produced a similar performance over the longer term under both major UK political parties. Looking at the tenure of each major party since 1997 (and not including the coalition government from 2010 to 2015) the average total return per annum (including dividends reinvested) from the FTSE All-Share index has been broadly similar under both a Conservative and Labour majority government.

The FTSE All-Share index has returned an average total return of 7.54% per annum under the Conservatives and 6.94% under Labour. Naturally, each period of control has encountered factors that have influenced global markets, such as the Global Financial Crisis of 2007-8, or the Covid-19 pandemic; however, it is interesting to note the broadly similar trend over time, irrespective of whoever is in power, which indicates – at least historically – that politics has little influence over the longer-term market performance.

A short-term boost for UK equities?

We have also looked at historic data to understand the potential for the General Election to be a catalyst for stronger domestic market performance in the short to medium term. In theory, an incoming government may be able to introduce greater fiscal stimulus, or boost public spending, as a result of their policy decisions. The same could, however, also be said for an incumbent government, who are emboldened to carry out manifesto pledges.

Our analysis of the UK stock market performance immediately after an election shows a similar trend, with the performance under both major parties being broadly similar; however, what is notable is the historic strong performance seen in the 12 months immediately after a change of government.

In 1997, when Tony Blair won a large majority for Labour, the FTSE All-Share index produced a total return of 35.6% over the 12 months immediately after that landslide victory. Similarly, under the coalition formed by the Conservatives and Liberal Democrats following the hung parliament in 2010, the FTSE All-Share produced a total return of 17.8% in the following year.

Comparing the returns in election years where power changes hands, to those where the incumbent party remains in power, indicates a marked difference in performance, with an average total return of just 2.5% being achieved by the FTSE All-Share index in the 12 months following a General Election when the ruling party retains power. This does, therefore, suggest that a change of government could prove beneficial for UK equities, at least in the short term.

Should investors be concerned?

Naturally, a General Election can cause uncertainty, particularly when considering any potential changes that will be implemented over the course of a parliament that could affect financial planning decisions. When it comes to market performance, however, we feel the upcoming General Election will have a limited impact, as the direction of UK equities markets continue to be dominated by geopolitics and global events, together with decisions taken by the Federal Reserve in respect of US interest rates. Indeed, we feel the US election in November has far greater potential to influence the direction of UK Equities than our own General Election on 4th July.

That being said, we feel investors should take the opportunity to assess how their portfolio is positioned, both in terms of asset and sector allocation. Our experienced advisers can take an unbiased look at an existing investment portfolio, to make sure that the portfolio provides adequate diversification and meets your needs and objectives. Speak to one of the team if you have any concerns about the impact of the General Election on your portfolio.