Source: Investing.com

Gold is having its day in the sun, but for how long?

Long before Bitcoin was even a twinkle in the eye of its alleged inventor, Satoshi Nakamoto, there was gold. If you did not trust rulers, institutions or paper money, gold was what you owned to protect your finances. Its value/weight ratio made it ideal as way of keeping your wealth nearby should you need to flee the kingdom at short notice.

Today there are still a few who believe the only real currency is gold. They bemoan the 1971 decision of Richard Nixon (the US president notorious for the Watergate scandal) to take the US dollar off the gold standard (then fixed at $35 an ounce). The pound sterling abandoned the gold standard 40 years earlier.

Apart from a small minority of believers in gold-as-currency, the rest of the world has grown used to fiat currencies, that is, currencies which are not backed by anything beyond the government that issues them (not good news if the issuing government is Argentina).

Nevertheless, gold has continued to have a role in the financial world. Most central banks hold gold in their reserves, alongside fiat foreign currencies. The UK has almost 10 million ounces (282 tonnes) in its vaults. Other central banks, such as China’s, are increasingly looking to gold as an alternative to the US dollar, having seen how the US has weaponised its currency in recent years.

As an investment, gold has two obvious drawbacks:

- It does not produce an income; and

- Holding it has costs in terms of storage and insurance.

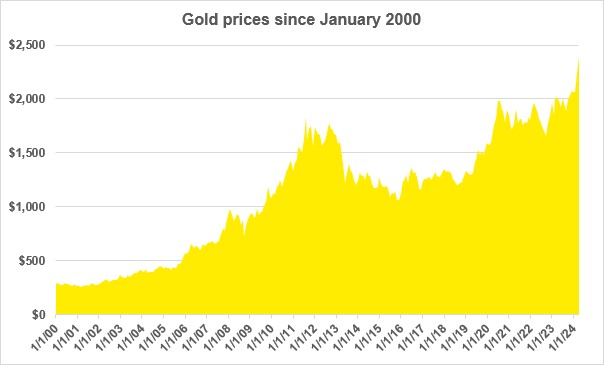

Those disadvantages have not stopped gold from attracting investors looking for a tangible alternative investment to shares and bonds. As the graph shows, gold investors do not have a smooth ride. If you bought gold in August 2011 (at $1,830 an ounce), you would have needed to wait almost nine years to see a dollar profit.

In recent months, gold has risen sharply, as the spike on the graph shows. Why this is happening has puzzled the experts, as today’s higher interest rates have traditionally been bad news for the shiny metal. If you are tempted to buy gold, have a look at that graph, think about 2011–2020, and then – if you still have the gold bug – take advice on investing. The wrong choice could see 20% VAT added to the price.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.