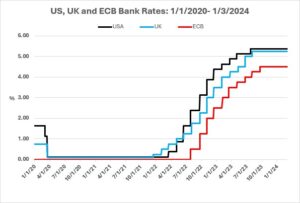

Interest rates have risen for two years straight, but the outlook indicates a change of direction in 2024.

Source: Federal Reserve, Bank of England, European Central Bank

The Bank of England raised its bank rate from 0.10% to 0.25% just before Christmas 2021 and from that point until September 2023 UK interest rates only moved in one direction: upwards. Then, after fourteen consecutive increases, the Bank pressed pause at 5.25%.

There is now an expectation, not disputed by the Bank’s Governor or Chief Economist, that the next move will be downwards. As the graph shows, the UK’s interest rate pattern of rise and stall has been mirrored by two other major central banks, the US Federal Reserve and the European Central Bank (ECB).

However, in 2024 central bankers will want convincing evidence that the inflation dragon has been slain before the ratchet down begins. A cut too early could force a reverse in direction if inflation returns.

Investment reaction

Nevertheless, markets are anticipating rate cuts. The yields on 10-year government bonds have fallen since last autumn in the UK, US and Europe as investors decide to lock in to current rates. The knock-on effects are visible in the UK mortgage market, where new fixed-term rates have started to drop.

NS&I has also reacted, withdrawing its popular one-year guaranteed bonds, cutting the Premium Bonds prize rate by 0.25% and reducing the return on its three-year green bond from its peak of 5.7% from August to November 2023 to just 2.95% now.

If you have been holding cash deposits, either directly or via money market or similar funds – perhaps in an ISA or a SIPP – you should have benefited from the rise in rates. However, unless your deposits were on average earning within 0.7% of bank rate – after allowing for tax and any charges – your deposit growth would not have kept pace with inflation in 2023, yet alone 2022. In fact, in the last 15 years it has been rare for the bank rate to be higher than the CPI inflation rate.

Deposits review

That historical failure to keep pace with inflation, combined with the likely fall in rates, means that now is the time to review the amount of cash you hold on deposit. For all but the most cautious investor, deposits are not suitable as long-term investments. If your goal is income, you could consider fixed-interest funds to take advantage of current long-term bond rates. Alternatively, equity income funds, investing in the UK and internationally, offer attractive dividend yields with potential for long-term income growth.

Talk to us about your options now: deposits may be less attractive once the lines on that graph start marching down.

Investments do not offer the same level of capital security as deposit accounts. Investing in shares should be regarded as a long-term investment and should fit with your overall attitude to risk and financial circumstances. The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. The Financial Conduct Authority does not regulate tax advice and advice on cash deposits. Tax treatment varies according to individual circumstances and is subject to change.