New research reveals that one in three people could face hardship in retirement.

Source: Frontier Economics based on Scottish Widows survey data

The “cost of living crisis” is a phrase that is hard to avoid in any media. High inflation, stealthily increasing taxation and constrained earnings growth are an unwelcome combination that leaves few of us unaffected. In time, the crisis should pass. It is easy to forget now that a little over two years ago, in July 2021, inflation was bang on the Bank of England’s target, at 2.0%.

The understandable focus on today’s living costs does not mean that future cost of living issues have disappeared. To examine this point, one of the UK’s major insurance companies has launched a National Retirement Forecast (NRF) designed to capture a snapshot of the UK’s future retirement landscape.

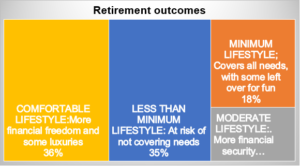

The forecast uses the Pension and Lifetime Savings Association’s (PLSA) ‘Retirement Living Standards’ levels to estimate the lifestyle that people are set to achieve when they stop working. These standards, covering minimum, moderate and comfortable retirement lifestyles, are updated each year to take account of price increases and changes in retirement spending patterns. The latest set, published in January 2023, show that in 2022 the yearly cost of a minimum retirement lifestyle increased from £10,900 to £12,800 (18%) for a single person and from £16,700 to £19,900 (19%) for a couple.

The new forecast starts with projections based on the current savings and behaviours of individuals and takes a comprehensive view of sources of retirement income, including pensions, other long-term savings, inheritance, and accounts for any housing costs. Those projections are then compared to the PLSA’s standards to show the distribution of lifestyles in the future retired population. All the calculations are made in today’s money terms.

The main conclusion is that over a third of the population are not on target to achieve even the minimum lifestyle standard when they reach retirement. However, an almost identical proportion are currently set for a comfortable retirement.

It makes sense to find out which retirement outcome you are on track to achieve, as the sooner you know, the more time you have to adjust your plans accordingly.

Speak to one of our experienced financial planners here if you would like to discuss the above further.

The value of pensions and investments and the income they produce can fall as well as rise and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.