Why business owners need to find time to focus on financial planning

As anyone who runs a business will appreciate, time is a precious commodity. Making strategic decisions, effectively managing staff, and building relationships with customers and suppliers mean that business owners rarely have time to consider the important role that sensible financial planning can play in both the success of the business and the long-term financial security of key individuals.

Profit extraction via pensions

Whilst the long-term goal is to make the business more successful over time, business owners need to make sure that they don’t ignore their personal finances and in particular their retirement plans. By making regular pension contributions, business owners can save for retirement in a tax-efficient manner. Depending on how the business owners are remunerated will determine the most tax-efficient way that pension contributions are made, and we recommend business owners seek independent investment and accountancy advice to choose the most appropriate route. Pension planning can be particularly useful when business owners near retirement, providing a tax-efficient method of extracting profits from the business.

Protecting your interests

In our experience, many business owners, shareholders, and key personnel are running huge risks by not holding adequate protection against the worst-case scenario. The death or serious illness of a business owner or key individual in the business could have devastating consequences for the future success of the business and its employees.

A situation we commonly come across is where a shareholder in a small business leaves shares in the business to their spouse on death. However, the spouse may not have any interest in being a shareholder in the business, and would prefer to sell the shares in the business to other shareholders. This would involve other shareholders needing to raise finance to buy the shares, which often can be prohibitive. By arranging shareholder protection in an appropriate manner, life assurance would be arranged in a tax-efficient way to provide the necessary funds for the surviving shareholders to buy the shares from the spouse.

Another common risk that is often ignored is the potential for death or serious illness of a director, owner, or key member of staff, without whom the business would face significant risks to profitability and success in the future. By arranging appropriate cover, in the event of ill-health or death of the key employee, policy proceeds are paid directly to the business to help replace the key person and help cover any profit loss.

Benefits to retain key staff

A crucial component of any successful business is the ability to recruit and retain key staff. As an indirect result of the pandemic, some industries have faced an imbalance between vacancies and applications, exacerbating the need for employers to stand out from the crowd. One method of achieving this is to offer key employees a strong package of employee benefits, which can be arranged in such a way that they are tax-efficient for the business. Death in Service, essentially a group life policy, is a cost-effective way of providing life assurance for key staff. Additionally, arranging a Group Private Healthcare policy is another attractive benefit that can work to the benefit of the employee, and also the employer, as a way of ensuring that staff return to work as quickly as possible after suffering ill-health.

Another valuable benefit is for business owners to arrange enhanced pension arrangements for key personnel. Whilst many firms choose to use a Master Trust arrangement such as NEST or People’s Pension to provide their employees with a pension under the auto-enrolment legislation, these schemes tend to offer employees limited choice and can be expensive. By providing key staff with bespoke pension advice, and setting up a Group Personal Pension or Individual Pensions, this can provide staff with a greater range of options and competitive terms.

Making company cash work harder

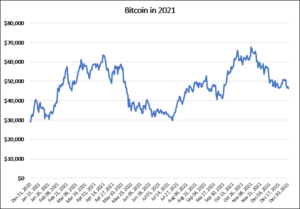

Many successful firms tend to carry large balances in cash, and if these accumulated funds are not earmarked for any business purpose, leaving surplus funds on a company bank account will mean that funds are left unproductive. In particular, given the current levels of inflation at present, cash is generally producing a negative real return (i.e. taking inflation into account) of around -5% per annum. Business owners should consider funds that truly are surplus to immediate requirements (but might be required in the longer term business strategy) and consider alternative options that aim to keep funds productive. This can be in the form of term deposits or other interest-bearing cash, or a cautiously managed investment portfolio, aiming to produce positive returns over time, with lower levels of volatility. Business owners should always seek advice before proceeding, as investing significant sums could have implications in respect of the trading status of the company; however, we will be able to work with your company accountant to avoid any adverse consequences.

How we can help busy business owners

It is our experience that business owners generally appreciate the benefits that independent financial planning can bring, but rarely have the luxury of time to consider these options in more detail. That’s where FAS can assist. As a Chartered practice, we can provide a comprehensive service, considering a company’s protection needs, implementation of employee benefits packages, and reviewing business owners’ personal finance, thus avoiding the need for business owners to deal with these aspects individually.

If you are interested in speaking with one of our experienced financial planners to review your business needs, please get in touch here.

The value of investments and the income they produce can fall as well as rise. You may get back less than you invested. Past performance is not a reliable indicator of future performance. Investing in stocks and shares should be regarded as a long term investment and should fit in with your overall attitude to risk and your financial circumstances.