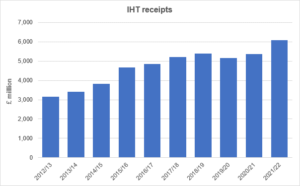

New data from HMRC show the Treasury’s inheritance tax (IHT) receipts have doubled since 2012/13.

Source: HMRC.

Of all the various taxes levied in the UK, IHT is one of the most peculiar:

- For a start, its name is misleading. In other countries that levy inheritance taxes, the tax is usually based on the inheritor and the amount that they inherit. In the UK, the tax would be more accurately described by its former name, capital transfer tax. Think tanks regularly suggest IHT should change from a levy on donors to a tax on recipients. In theory, the switch would encourage a wider distribution of assets. It could also raise considerably more revenue.

- IHT is often described as the UK’s most hated tax. However, the amount of tax it raises for the Exchequer is small change: it is worth about 1% of the total produced by the three main taxes – income tax, national insurance (yes, that is a tax) and VAT.

- The great majority of estates do not pay any IHT. For married couples and civil partners who are homeowners with children, IHT is usually not an issue until their wealth exceeds £1 million. Statistics from HMRC show that in 2019/20, only 3.76% of estates suffered the tax. In practice, nearly half of estates will escape IHT simply because there is generally no tax on transfers between married couples and civil partners. However, this exemption does not apply to unmarried couples – in IHT there is no such concept as a common-law spouse.

New figures from HMRC show that in 2021/22 the IHT receipts rose by nearly 14%, with the average IHT bill faced by that small minority of taxpaying estates with a value of just over £250,000. One reason for the increase is the fact that the nil rate band is frozen. The freeze started in 2009 and its term has regularly been extended – the “thaw” is not now due to arrive until April 2026. With inflation surging, over three more years of freeze will drag more estates into the IHT net.

If IHT is a concern for you, there are a variety of ways to reduce its impact on what your children or grandchildren will inherit. It will not surprise you to learn that with such a misunderstood tax, the starting point is professional advice.

If you would like to discuss the above further then speak to one of our experienced advisers here.

Tax treatment varies according to individual circumstances and is subject to change. The Financial Conduct Authority does not regulate estate or tax planning or will advice.