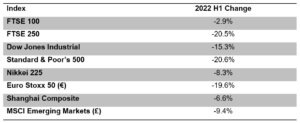

The world’s share markets had a bad first half of 2022, but for once the UK performance was better than many.

Source: UKinvesting.com

The first six months of the year was a disappointing one for many investors. The S&P 500, the leading US market indicator, had its worst first six months since 1970.

To be fair, it was a tumultuous first half:

- After years of quietly treading water, inflation took centre stage. In the UK the annual CPI rate jumped from 5.4% at the end of 2021 to 9.1% by May 2022, with the Bank of England forecasting a peak later this year of above 11%. In the US, the corresponding move was from 7.0% to 8.6%, while Eurozone CPI echoed the UK’s, rising from 5.0% to 8.6% by June. Even Japan, a land famed for years of deflation, was experiencing 2.5% inflation by May.

- Short term interest rates were raised in response to inflation. The Bank of England increased rates by 0.25% at each of its four meetings in the first half of the year, while the US Federal Reserve did not start raising rates until March but ended June with an overall increase of 1.5%. The European Central Bank remained with a zero rate but said it would make an increase in July.

- Long term interest rates also jumped. In the US, the yield on the 10-year government bond doubled, from 1.51% to 3.02%, while the UK 10-year gilt rates more than doubled, from under 1% to about 2.25%. However, in this instance the most dramatic change was in the Eurozone. Having spent most of 2019 and all of 2020 in negative territory, the German 10-year government bond rate went from a -0.18% to +1.37% over the first six months of 2022.

- On 24 February Russia invaded Ukraine. The initial expectations of a short campaign proved wide of the mark and as fighting has dragged on, the impact on world energy markets has grown. The Brent crude oil price ended June 41% higher (in $ terms) than at the end of December. That rise has been exacerbated in the UK by a 10% fall in the pound against the still mighty US dollar.

The outlook for the second half of 2022 is for further increases in short term interest rates, but beyond that nothing is certain – some are already claiming to see a turn in inflation on the horizon. The one source of solace is that if you are investing money into the markets now, in most instances you will be getting much better value than six months ago.

If you would like to discuss the above with one of our experienced advisers, please get in touch here.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.