After years of slumber, the inflation dragon is stirring. Are you prepared to meet the challenge?

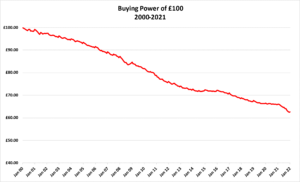

Source: Office for National Statistics

In mid-January the Office for National Statistics (ONS) published the final inflation figures for 2021. CPI annual inflation reached 5.4%, its highest in nearly 30 years, and RPI inflation – no longer an official statistic – hit 7.5%. Twelve months earlier the same inflation measures had been just 0.6% and 1.2% respectively. The sudden return of inflation has surprised many, including the Bank of England. It is now reacting in the way central banks normally do when faced with rising inflation, by raising interest rates. But what should you be doing?

Check your protection

As the graph shows, the mirror image of inflationary price rises is the falling value of money. With inflation at 5.4%, the pound of a year ago is worth less than 95p today. Over time that diminution of value escalates: the £1 of January 2012 was worth 82.3p by January 2022. If you have life cover, critical illness cover or income protection that pays a fixed amount, then its value to your family is similarly being eroded. To maintain their protection, you should consider arranging some top up cover.

Review your retirement planning

Inflation means that, all other things being equal, you will need a larger pension pot to fund your desired standard of living in retirement. There is only one way to do that: your pension contributions will need to increase. Even if your contributions are directly linked to your earnings, that may not provide a sufficient increase – the latest ONS data show earnings growth lagging behind price inflation.

If you are about to draw your retirement benefits, inflation is a major consideration in determining the initial level of income you take. Seek advice on the unavoidable trade-off between your chosen starting level of income and the scope to protect your future income from inflation. The value of a fixed annuity bought twenty years ago will have eroded significantly. While there is now much greater choice in how to draw your retirement income, the basic laws of economics have not changed.

Beware holding excess cash

Inflation is generally bad news for bank deposits. Admittedly the Bank of England is now lifting rates, but there remains a huge gap between deposit and inflation rates. We all need to hold some readily accessible funds, but make sure that if you are holding more than you need as a rainy-day reserve, you have a good reason for doing so because it comes at a cost.

Reassess your investment strategy

An investment strategy that has worked well in the era of low inflation and near zero interest rates may not be as appropriate when inflation and interest rates are both rising. An obvious area for review is holdings in fixed interest investments, which suffer when inflation devalues future payments.

If you are interested in discussing the above with one of our experienced financial planners, please get in touch here.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances. The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.