The first six months of 2021 have been rewarding for investors, but the next six are uncertain.

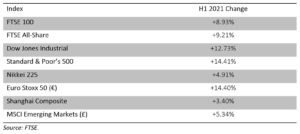

The first half of 2021 was a much less traumatic ride for investors than the first half of 2020. With hindsight, last November’s Pfizer/BioNTech vaccine breakthrough announcement gave investment markets a fresh momentum that continued through the first two quarters of 2021, particularly in the US.

However, the drivers of performance have somewhat changed in the past 12 months. Last year was the year of technology stocks, with the likes of Apple, Microsoft and Amazon leading the way. In 2021, that has not been the case, even though the top five technology stocks account for more than 21% of the S&P 500 index value. Research by Bloomberg shows that in the first half of 2021, information technology (IT) was a drag on the S&P 500. Strip out IT from the index and it would have risen by 14.9%, not 14.4%. Alternatively, give each share in the index an equal weighting – so those top five companies become just 1% of the index – and performance over the first half would have been 18.3%.

The cooling of US tech stocks helps to explain why the Eurozone, as measured by the Euro Stoxx 50, matched the S&P 500 in the first six months of the year. Even that is not the whole picture though, as the dollar strengthened by about 2.5% against the euro over the period, leaving the US market the winner in currency-adjusted terms. Most indices are based on the relevant domestic currency, with currency-adjusted versions largely the domain of professional investors.

Will 2021 now prove to be the proverbial game of two halves? There are two obvious uncertainties ahead:

- During the first half of this year, inflation was on the rise globally. The worst/best example is the US where CPI inflation was 1.4% last December but rose to 5% in May. At present, the consensus view is that this inflationary jump is ‘transitory’. By next January, we will have a good idea of whether that is the right judgement. If it is not, interest rates could rise – something the markets would not welcome. If it is correct, rate rises will likely remain distant and markets happy.

- The pandemic is not yet over, especially outside the developed world. Covid-19 has already surprised in a variety of ways and could do so again – for good or bad.

The first half of 2021 showed how markets change underneath the headline numbers. To benefit from such movements, professional investment management is vital.

If you are interested in discussing the above with one of our experienced financial planners at FAS, please get in touch here.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.