Research from the Institute for Fiscal Studies (IFS) examines how pension contributions fit into life-cycle patterns.

Economists often seem to think in a way that is unique to their world. Many of their theories start with the assumption that people behave rationally, weighing up all the pros and cons before deciding what action to take. Impulse-buying doesn’t compute with these expected behaviours.

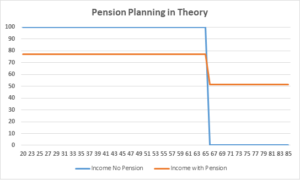

One interesting economic viewpoint that holds some logic for the person on the street is the concept of pensions as deferred pay. The economist’s notion of retirement planning can be summarised by this graph:

The economic argument is that a pension should be regarded as deferred pay, so that instead of income stopping in retirement (the blue line) a lower income is accepted before retirement to provide some income (2/3rds in this example) after retirement – the orange line. Income is therefore, in theory, smoothed throughout life and continues into retirement. Ignoring all inflation – as only economists can – the total income in both scenarios is the same. The difference is in how it is distributed over a lifetime: Earnings foregone during an individual’s working life re-emerge as a retirement pension.

This deferred pay approach was the starting point for some research undertaken by the Institute for Fiscal Studies (IFS). It looked at both theory and practice and suggested the following pattern for pension contributions:

- Automatic enrolment rules mean that for employees, contributions should always be at least at the minimum level to require payment of an employer contribution.

- Families with children tend to make contributions above the minimum before children arrive and/or after they have left home.

In England and Wales any outstanding student loan debt (for those entering higher education from 2012) is currently written off after 30 years. Thus, from around age 52, many graduates will have an increase in net income that can be directed towards retirement contributions.

The IFS suggests that although this approach loads contributions to later in working life, it is an effective way of building up the retirement pot. Its baseline calculations, allowing for earnings growth, are that around 80% of contributions will be made between 45 and 66, providing around three quarters of total retirement wealth.

If you are interested in discussing a more tailored contribution pattern based on your personal circumstances with one of our experienced financial planners at FAS, please get in touch here.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances. The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.