The Chancellor has asked the Office of Tax Simplification to review capital gains tax.

Within a week of giving his Summer Statement, the Chancellor wrote to the Office of Tax Simplification (OTS) asking it to “undertake a review of capital gains tax (CGT) and aspects of the taxation of chargeable gains in relation to individuals and smaller businesses”. The request was unexpected and prompted some press speculation that Rishi Sunak was beginning his hunt for extra tax revenue after the unprecedented spending on Covid-19.

CGT is certainly an interesting place to start:

- The latest data from HMRC show that there were fewer than 300,000 CGT payers in 2017/18.

- Nearly two-thirds of the tax raised in that year came from 3% of CGT payers who made gains of £1 million or more.

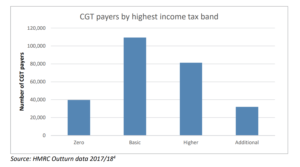

- Over half of the CGT payers either paid no income tax or paid it only at the basic rate, as the graph below shows.

The main reason why CGT payers are such a rare breed is the annual exemption. For 2020/21 this allows up to £12,300 of net gains to be realised before any tax becomes payable. Even then, the maximum tax rate is 20% (28% for residential property). In the last election, both the Labour Party and the Liberal Democrats called for gains to be taxed at full income tax rates and for the exemption to be cut to just £1,000 or abolished. The Conservative manifesto made no comment – CGT was not one of the taxes for which a rate freeze was promised.

Neither Mr Sunak nor the OTS has put any date on when the review might be published. However, the OTS has asked for all comments to be in by 12 October, so government proposals might emerge in the Autumn Budget, particularly if that Budget appears later in the year.

There is a precedent for changing CGT rates part way through a tax year – as then Chancellor George Osborne did in 2010. With this in mind, a wise precaution could be to review your portfolio and consider whether you wish to realise any gains in the next few months, while the current generous CGT regime is in place.

If you are interested in discussing your options with one of our experienced financial planners at FAS, please get in touch here.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice. The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.